Introduction

This project model is all about discussing vital information about management accounting systems. It has been determine that company is always looking to gab new opportunities those are valuable in order to attain their future aims and objectives. The role of finance officers is to make use of appropriate accounting systems in order to make entries of financial transaction incurred during the time. This project report is providing vital information about various accounting system and reporting those are essential for them. While use of costing methods in calculating net profit for Tech Imda are discuss under this report. Merits and demerits of using various types of budgets are discussed effectively. Use of balance scorecard in order to resolve financial issues are assist in this particular report (Amoako, 2013).

Task 1

P1: Management accounting and their essential need for Imda Tech

In accordance with using crucial accounting systems in organisation are primary reason for the company. According to be mentioned case study of Tech Imda, it has been analyse that there financial performance are not effective during the last couple of year. To make analyse their valuable implication they are appointed a financial analyst to overlooks all necessary financial statements in more effective manner. Management accounting is a systematic process of recording, summarising, communication and analysing their implication to an organisation. This will assist owners of the company to make use of valuable decision to control their all expenses and costs those are applicable during the course of action (Brewer, Sorensen and Stout, 2014). The role of managers is to analyse all crucial aspects those are vital for the company in order to increase their efficiency and growth during the period of time. There are various types of systems which can be helpful in making better understanding of decision making in near future time. It has been found that their certain specific comparison among financial and management accounting. Both of them are different on the basis of their nature and characteristics.

|

Management accounting |

Financial management |

|

This seems to make proper analysis of all reports that are prepared by during the period of time. |

In this case, managers use to make report by collecting necessary information from various departments. |

|

It does not require any kind of calculation and analysis of financial statements. |

Under this, entrepreneur has plenty of rules and regulation needed to be followed to make decisions. |

|

The time horizon is identified through the company itself. |

The primary focuses are made on the financial years of an organisation. |

|

Besides value data, it is generally provide specific ideas of quantitative data made by the accountant. |

All vital information in the financial statement is mostly distinct as per the required financial regulations. |

Importance of using management accounting system:

It is a helpful for an organisation to make appropriate decision making in order to attain future aim and objectives. Another crucial aspect of using various accounting systems is to enhance efficiency of Tech UK in coming time. This is preparing accurate and timely financial as well as statistical data to managers in order to make short terms obligations.

Types of accounting system:

Cost accounting system: It is an effective process of recording, classifying, evaluating and allocating alternative actions in order to control overall costs for an organisation. The primary aim is to advise the management in the vital course of action those are relies on cost efficiency and capability of an organisation. This will guide accountant to analyse overall production done during the period of time.

Inventory management system: It is said to be ongoing process of moving effective parts and products into the company’s location. It is responsibility of managers to control their stock on regular basis as they place any new orders for their product. This will assist in analysing overall performance by measuring overall quantity of product owned and kept by a business that is related either for resale or as raw material (Lim, 2011).

Job costing system: It is an essential system for assigning production costs to an individual product or group of products during the period of time. Basically, the job order costing is useful only in case of products produce are relevant from one another.

Batch costing: It is more similar just like job costing in which every information regarding product manufacturing data and time are recorded effectively. Total list about group of batch produce during the time are mentioned under this costing.

Contract costing: This seems to be continuous flow of costs that are associated with a particular contract. It is use to track cost those are related with a particular contract in accordance with a customers.

Product costing: It is a kind of cost that is related in order to create an specific product. These costs consists of direct labour, direct material and factory overhead.

Service costing: This particular process which is associated with operating cost that is used by an organisation that produce services to the customers instead of developing products.

P2: Different method of accounting reporting

In every organisation, whether related with retail or manufacturing they need to make use of valuable information in order to generate more crucial outcomes during the period of time. Business reporting is said to be summarise form of all financial information which are collected from various department in order to identify current position of the company. On the basis of this report crucial decision are needed to be taken by the managers. There are different sources from which information would be collected such marketing, finance and operational department. Every data will be collected, summarise, communicate and make valuable comparison on the basis of past position (Tessier and Otley, 2012). These reports are presented by the company in front of investors and external stakeholder to analyse and make valuable investment decision in their ongoing projects. There are various types of accounting reporting method those are helpful for an organisation to record crucial information associated with the company’s present time performance. Some of them are discussed underneath:

Performance report: It is an essential activity in accounting system. It consists of collecting and disseminating project data, communication of upcoming growth in project, proper utilisation of resources and future progress as well as different stakeholders. The analysis is done by evaluating actual performance with the present time position of the company. An yearly performance report could be produce for every employee of Tech Imda so that they can able to increase their skills and capability.

Account receivable report: According to this particular report which is made to determine total list of unpaid customers bills and unused credit memos as per their mentioned date. This particular report is happens to be primary tools which will be used for collection of personnel to analyse which amount is still outstanding for payment.

Inventory management report: as per this particular report which is use by Imda tech to manage their stock position those are incur during the period of time. By the help of this report all necessary detail about opening and closing entries of data is being recorded in effective manner. There are various accounting techniques which are needed to be use for the purpose of analysing position of stock such as inventory turnover ratio and Economic order quantity level.

Job cost report: this particular report is the initial place of the data contained in under the report. All list of job a company are working on and list of total cost which are incurred on the job in period of time are recorded in this particular report. This must allow total number of lot size of products a company is able to produce during the period of time (Zoni, Dossi and Morelli, 2012).

M1: Advantage of types of management accounting system

In accordance to generate more valuable outcome for the company in near future, they need to make use of appropriate accounting system those are helpful to analyse financial stability at that period of time. All essential types of systems those are discussed above are having their own benefit which makes them separate from one another. Such as cost accounting system is more reliable tool that assists an organisation to delivery more specific outcomes in respect to costs and expenses. While some other are job costing, inventory management system are effectively important to increase profitability for the company.

D1: Critical evaluation of various types of reporting method

On the basis of all detail report those are prepared by the managers in order to determine current position of the company is essential aspects for Tech UK. These reports are presented to the investors and stakeholder for the purpose of making valuable decision regarding capital investment in their projects. Some of them are performance report which is necessary to be analyse on continuous basis to remove any obstacle arise during progress of a project plan.

Task 2

P3: Various types of costing method use in calculation net profit

Cost is a necessary aspect for every business organisation in order to increase overall production for the company. The cost is directly or indirectly related with the production process in the form of direct labour, material or other essential overheads. It is the value of amount which is being given by the company to get something. There are various types of costs which are associated with the manufacturing of electronic gadgets. Such as:

Cost volume profit: According to this particular analysis which is used to examine about modification in costs and volume which affect a company’s total operation revenue and net profit during the period of time (Klychova and et. al., 2015).

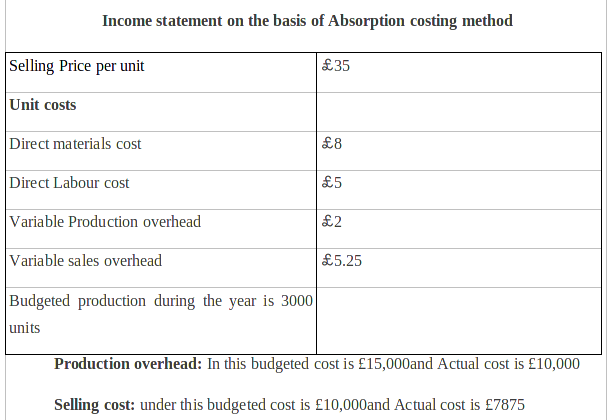

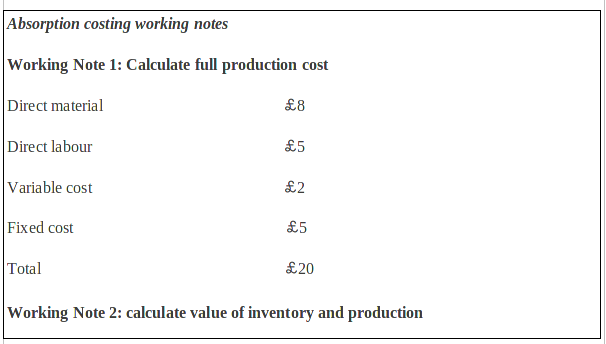

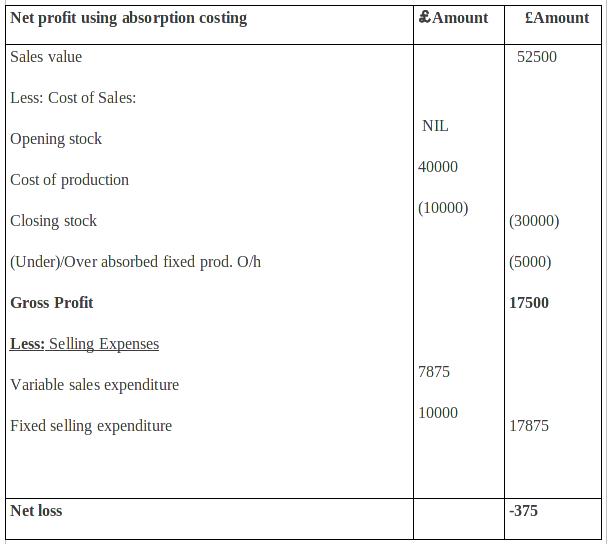

Absorption costing: It refers to the important types of costing method which is related with all manufacturing process. It consists of both variable and fixed costs because of this; it is termed as full costing sometime (Absorption costing, 2018). In order to make future decision managers cannot consider this tool more reliable for making valuable decisions.

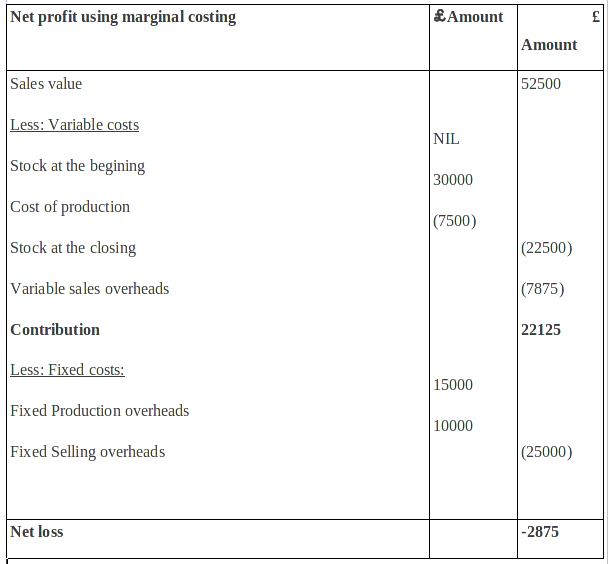

Marginal costing: According to this particular costing method which is said to those cost which is incur with the production of additional units during the time. It included only variable cost and fixed costs are taken as just to analyse total contribution they are getting from overall sales. In respect to make future decision, it is consider more dependable and reliable up to a great extent.

M2: Analysing various accounting techniques

In respect to analyse the overall performance of Tech Imda, it is necessary to make use of appropriate accounting techniques. It will assist an organisation to make reliable and accurate results in terms of increasing overall productivity by using proper resources in right manner. Some of the techniques are said to be standard one which are use by an organisation to evaluation their actual target which are being set before delivery product to their customers. Historical cost are also need to be considered because on the basis company use to make certain comparison.

D2: Critical evaluation of incomes statement

|

Reconciliation statement |

|

|

Net profit as per the financial account |

-375 |

|

Add: Under absorbed cost |

5000 |

|

Selling cost |

2125 |

|

Net profit as per cost account |

6750 |

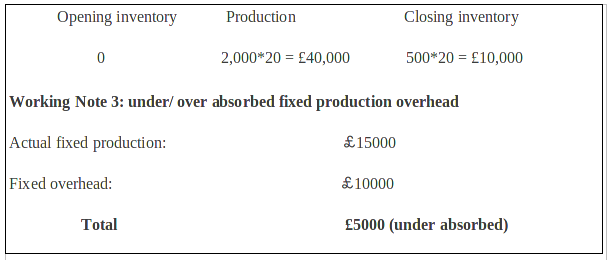

It has been found that managers of Tech UK can use two of the most important costing method which are will assist them to get more close results. Those two are absorption and marginal costing. In case company go with marginal costing they are able to get negative loss of 2875. While with the use of absorption costing they are able to incur 375 losses during the period of time. The results are not in the favour of the company. They need to cut down their expenses those are incurring during the production process. After deducting all necessary under absorbed cost those are incurred during the financial accounting period. On that basis, they are able to earn a net profit of 6750.

Task 3

P4: Merits and demerit of various types of budgets

It has been seen that a company can only attain its aims and objectives in case they are using right planning tools which would assist them to control budgets in more effective manner. There are various types of budget Imda can use in their daily business growth. Some of them are discuss underneath:

Operation budget: According to this particular budget which will be use by managers to analyse their total cost and expenditure incur during the time of production process. It includes proper estimation of total values of resources those are needed for the performance of any operations (Bovens, Goodin and Schillemans, 2014).

Advantage: According to this particular budget which is used by an organisation to track their entire business. It would indicate both amount that is spend and cost which is needed to make any products.

Disadvantage: Time factors are the important aspects which are needed to be considered by the managers. An experiences person can attempt to consider effective tools which are needed for the company are missing under the plan.

Cash flow budget: According to this particular budget which is prepared by the account offices to determine total flow of cash which is going from business or coming back. These primary sources of budget preparing are taken from various activities such as investing, operating and financing.

Advantage: It does not able to consider time value of factors. Proper flow of cash will be easily being identified as deficit form or surplus.

Disadvantage: It is used to analyse cash receipts and cash disbursement for the period of time. The major limitation is that once the recovery period is completed it can be able to provide reliable outcomes for the company (Klychova, Faskhutdinova and Sadrieva, 2014).

Financial budget: It is known a combination of balance sheet that indicate all effects of planned operations and capital investments related with assets, debts and equity. It consists of a cash budget that is prepared to forecast total flow of funds.

Advantage: One major advantage of having a financial budget for the company is to recognise total opportunities that can assist in the market and increase the overall budgets for the company.

Disadvantage: It can be able to deal with more subjective problems such as quality of products those are delivery to their customers.

Capital expenditure budget: These are those funds that are being used by the company to attain, upgrade and maintain physical equipments as per the property and assets.

Advantage: This can assists an organisation to determine overall risk that consists in investment opportunities.

Disadvantage: It relies on estimation of future cash flows and related outflows.

Process of budget preparation:

- At the initial stage of budget preparation, it is essential to make budget requirement. This seems to analyse of various ideas about requirement of new budgets.

- In the next stage, getting detail of budget assumption by making review from external or internal department. The primary sources are taken from different departments such as operational, finance and HR department.

- Examine availability of finance sources. It is an important aspects which can assist an organisation to run their business in more effect manner. For this purpose finance department need to collected funds from internal as well as external sources.

- Formulate budget package by taking necessary information from various experienced parties. Such as accountant, CA, auditors and strategic formulators as well as outside investors.

- Obtained revenue forecast. The revenue can only be attain by using appropriate capital that would required to plan their upcoming budgets.

- Review of budget. This seems to be done at the end of budget preparation. Information is collected from various customers and employees.

Pricing policy:

There arevarious types of pricing policies which are taken into account in order to implement various decision regarding product and services before transferring into the market. Some of them are:

- Price skimming

- Cost plus pricing

- Cost based price.

M3: Analysis of various planning tools

There are different types of tools which are used to control budget such as forecasting which is used to estimate total costs and expenses of the company. While contingency tools are helpful to identify total risk present in an organisation. The cash flow analysis is done to determine total flow of cash goes out from business in an accounting period of time. Budget analysis is use to determine total cost and expenses a company in investing in their ongoing projects. While ratios evaluation is done to determine total return, profitability and liquidity position of the company.

D3; Critical evaluation of financial issues

This has been analysing that there are plenty of financial issues which are present in an organisation. It makes huge impacts on the overall productivity of an organisation. To deal with them manager need to use key performance indicator and financial governance.

Task 5

P5: Balance scorecard

As per the mentioned case of Tech UK which is current determine that their financial account for the last couple of years which is indicating overall loss of £1.5million. In accordance to deal with this issues they have appointed a new accountant which will assist in remove all this issues (Sisaye and Birnberg, 2012). They recommend company to use balance scorecard to overcome all the financial problems. The company has looking to adopt balance scorecard approach to resolve financial issues. There are certain perspective associated with this:

Financial: It is an essential perspective which is related with organisational financial performance and make use of financial determinate during the time.

Customer: This views organisation performances from the point of view of client and other key parties.

Internal process: According to this, lenses of quality and their overall efficiency associated with the product of services can be determine easily.

Organisational capacity: It is an essential aspect by which human capital, infrastructure and technology can be analyse more effectively during the period of time.

With the help of this approach company would be able to deal with problems such as:

Profit level: It has been determine that company can have to face various issues which are related with low profit. By this, they are able to earn sufficient amount of gain during the time.

Product and services quality: According to this particular issues which are can arise because of less production of product and not delivery proper quality of services to the customers (Amoako, 2013).

There are various types of financial tools which are responsible to overcome these issues. Such as:

Key performance indicator: It is known as one of the important tools which is use to analysis financial issues by which actual performance with standard one can be determine in more effective manner.

Financial governance: This is said to be another significant tools which would consider being more specific to manage local government policy and regulation that are being set by company to operate their operations in more reliable manner (JOSHI and et. al., 2011).

M4: Evaluation of financial issues

This has been examining about all crucial financial issues those are affecting efficiency and performance of an organisation. It is used to deal with all sort of problems a manager required to determine different aspects those are helpful in enhancing total growth in coming time. There are various tools which are needed to be taken into consideration such as balance scorecard approach is said to be more accurate method to deal with any kind of financial problems.

Conclusion

From the above project report, it has been articulated that management accounting is an effective process which is needed to be determine overall growth for an organisation during the period of time. This can only be analysing by using accounting and reporting system which will increase valuable growth for the company. By the use of costing method net profit can be analyse effectively. All necessary data which is collected from this report are helpful in gaining sustainable growth for Tech Imda UK. Instant Assignment Help Australia assure you the best assignment help with the best grades.

References

- Amoako, G.K., 2013. Accounting practices of SMEs: A case study of Kumasi Metropolis in Ghana. International Journal of Business and Management. 8(24). p.73.

- Brewer, P. C., Sorensen, J. E. and Stout, D. E., 2014. The future of accounting education: Addressing the competency crisis. Strategic Finance. 96(2). pp.29-38.

- Lim, M., 2011. Full cost accounting in solid waste management: the gap in the literature on newly industrialised countries. Journal of Applied Management Accounting Research. 9(1). p.21.

- Tessier, S. and Otley, D., 2012. A conceptual development of Simons’ Levers of Control framework. Management Accounting Research. 23(3). pp.171-185.

- Zoni, L., Dossi, A. and Morelli, M., 2012. Management accounting system (MAS) change: field evidence. Asia-Pacific Journal of Accounting & Economics. 19(1). pp.119-138.

- Klychova, G.S and et. al., 2015. Management aspects of production cost accounting in horse breeding. Asian Social Science. 11(11). p.308