INTRODUCTION

Management accounting information is crucial for organisation to resolve various issues and improve upon its performance. Present report deals with importance of management accounting to Zylla Company by which performance may be enhanced in a better way. Types of management accounting and methods of reporting are also discussed. Moreover, calculation of marginal and absorption costing are done. Various planning tools are explained along with advantages and disadvantages of the same. Furthermore, management accounting systems are explained which could be used to adapt to respond to financial problems. Thus, such type of accounting information strengthens internal operations of the company.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

P1 Meaning of management accounting and requirements and types of accounting

Management accounting is a useful branch of accounting for the managerial personnel of the firm so that they may be able to take enhanced decisions in effective manner. This is essentially required as business operates in dynamic environment where changes takes place now and often. In such scenario, costs may be increased for manufacturing particular product and as such, revenue would be impacted significantly. Thus, business needs to make better decisions so that changes can be handled in effective way and this can be possible because of implementation of management accounting in the organisation. It refers to that part of management where the managers look out the needs of the business in relation to it operations, preparing financial reports i.e. to be used by the management, helps in decision-making and helping them in planning policies and strategies.

Management of firm relies on financial information which is provided to them with the help of financial accounting and from this, managerial reports are prepared and imparted to management in order to take better decision for the firm. Zylla Company also uses such accounting as it provides clarity from where it has to improve upon and initiate control upon expenses for injecting profits. Another essence of such accounting is that business can easily analyse costs incurred on activities which can be reduced up to a high extent (Aykan and Aksoylu, 2013). It helps organisation to effectively make decisions with much ease. In relation to this, requirements of different types of management accounting are as follows-

- Cost accounting-

Cost accounting is effective method as it analyse costs and then make attempt to reduce overall expenditures of the firm incurred on manufacturing commodities. This is quite useful accounting method as overall costs are assessed and unnecessary expenses are carried out which are not benefiting in the process and as such, they are reduced up too much extent. Zylla Company can be benefited by cost accounting as expenditures can be eradicated by cost reports imparted to management. It is essentially required by the firm so that expenses may not exceed total revenue. There are different types of costs such as variable, fixed, semi-variable, indirect and direct which are incurred and management can make enhanced decisions to initiate control upon the same. Thus, cost accounting is essentially needed in the company to minimise expenses and maximise profits.

- Price optimisation technique-

Price optimisation is another useful method which is used to carry out how demand varies with the change in price of the firm in the best possible manner (Burritt, Schaltegger and Zvezdov, 2011). It is mathematical model which is utilised to know how customer's behaviour changes when there is increase or decrease in price of particular commodity. This is used to assess whether customers are willing to purchase at the prevailing price or not. It helps organisation to quote price with regards to preferences of consumers and as such, price is quoted in relation to customer's demand. Thus, company can easily sell its products without any difficulty. Zylla Company should also rely on the price optimisation technique so that customers may be able to purchase goods in effective manner. It is important as when prices are high, rivals may drive away customers and when price are set low, profits cannot be garnered. Thus, through this method, firm can easily quote price which will be beneficial in every aspect.

- Inventory management-

Production is required so that company may be able to sell products in effective way. Customer demand can be easily met by the organisation in effective manner (Cadez and Guilding, 2012). For accomplishing desired production, inventory is needed in optimum quantum to achieve production. It is required in adequate quantity so that no spoilage may occur. Wastage is made when excess quantity is ordered by the production department and as such, extra costs of handling in the warehouse is incurred. On the other hand, if less stock is ordered, demand of production department cannot be accomplished. Thus, inventory requirement related managerial report is prepared and desired quantity is ordered which fulfills demand in the best possible manner. JIT approach is required so that no wastage may occur as inventory is used only when it is actually needed in production department. EOQ is useful tool to minimise ordering and carrying cost and purchase desired quantity.

- Job costing-

Manufacturing of products is done in order to achieve desired production and meet the demand of customers in effective way. When production is attained, various costs of manufacturing are incurred. Job costing is a method based on jobs performed by overheads which are incurred when production is accomplished. This is essentially required so that costs incurred on various jobs can be analysed and as such, reduction of expenses may be done in order to achieve maximum efficiency in the best possible way. It helps organisation to effectively minimise expenditures on jobs so that maximum production can be attained without incurring more manufacturing overheads. Zylla Organisation can easily attain production by controlling upon expenses in effective manner (Lachmann, Trapp and Trapp, 2017).

P2 Different methods of management accounting reporting

Various management accounting reports are described below-

- Segmental report-

There are various units in the company which performs daily operational tasks. Such units are also called as segments and are assessed by the management and report is provided to them regarding performances of varied segments in the best possible manner. The segmental report is also attached in financial statements which can be effectively utilised by users of accounting information to interpret financial health of the firm and take better decisions. This report is helpful for investors which may easily carry out whether investment should be made in the firm or not. On the other hand, creditors are benefited with regards to solvency position of company whether loan may be provided to organisation or not. The report includes revenue generated from operating segments. Moreover, it is made available by public entities and not private ones.

- Performance report-

This report is prepared to assess performance of something which is directly or indirectly helping organisation to achieve goals in effective manner. Usually, employees' performance is judged with the help of this report (Types of Managerial Accounting Reports, 2016). It means that performance can be evaluated by preparation of the report. Management of Zylla Company is easily benefited by this report as performance of employee's can be judged in effective manner and if it is not up to the mark, then improvement may be initiated so that performance can be maximised with much ease. Thus, variances found in actual results and planned one, corrective action can be taken so that lost productivity of employees may be attained.

- Inventory management report-

Inventory is required to be ordered in desired quantity as per the needs and requirements of the production department so that maximum manufacturing can be achieved in the best possible manner. This is required in optimum and adequate quantity so that it leads to no wastage. It occurs when more than required quantum of stocks are purchased, it increases handling expenses as it is needed to be stored in the warehouse. When the same is available in less quantity, desired production cannot be accomplished. In order to overcome this situation, inventory management report is prepared (Leotta, Rizza and Ruggeri, 2017). The production department provides clarity to the management regarding the requirement of inventory in order to accomplish customer's needs. This report is then provided to Zylla Company's management so that they may analyse demand and as such, required quantity is purchased and supplied to production department. Thus, spoilage of resources is eradicated as inventory is managed effectually.

- Job costing report-

Job costing is effective way of analysing expenses incurred on various manufacturing jobs engaged in the production process. In relation to this, job costing report and imparted to management so that costs on specific jobs can be assessed and measures can be taken to initiate control upon expenditures in the best possible manner which are not benefiting in overall production and reducing profits. Thus, with the help of job costing report, expenses on overheads can be controlled in a better way. Hence, Zylla Company can reduce expenditures on those jobs which are underperforming and direct those funds to good performing overheads helping in maximising level of production (MONEM and SAEIDI, 2017).

- Accounts receivables ageing report-

Customers are provided with goods on cash or credit basis. When goods are imparted to customers on credit, payment for the same is received afterwards within credit policy formulated by the firm. In relation to this, accounts receivables ageing report is prepared by the company so that it may be able to clarify how much amount is pending to be collected from the debtors. This report is formulated in which unpaid invoices of consumers are carried out along with their names and outstanding amount is listed as well. This help organisation to effectively extract how much money remains outstanding and as such, company can collect the same from the customers. If more amount is pending, firm needs to implement strict strategies so that payment may be recovered within stipulated time.

Benefits of management accounting systems

The management accounting systems have immense benefits to organisation. Costs can be analysed and controlled in a better way because of cost accounting. It is helpful as company is able to initiate control upon expenses in the best possible manner. Furthermore, enhanced decisions can be taken with the help of management accounting systems. On the other hand, firm is able to assess demand of customers by forecasting their requirements and as such, demand can be analysed and as a result, profits may be garnered with much ease.

P3 Computation of marginal and absorption costing

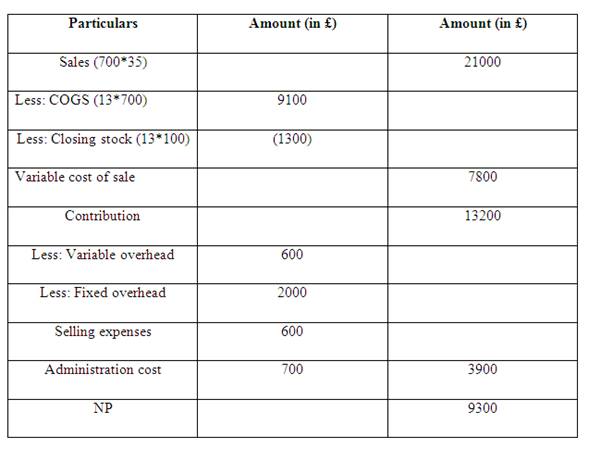

Marginal Costing income statement

Marginal/Variable costing is the cost which occurs when an extra unit of output is being produced. It includes all the direct cost required to produce a product i.e. the material, labour, and wages it also includes indirect cost i.e. Variable overheads. It can be interpreted that income statement on the basis of marginal costing is carried out above. The total sales revenue is 21000 having 600 units at per rate of 35. Cost of sales amounts to 9100 which is attained by 700 units at the rate of 13. From this, closing inventory is deducted which is 1300 having 100 units left for a period and having 13 per rate. Thus, variable cost is achieved as 7800. Contribution per unit is arrived at 13200 and from it, variable overheads are deducted amounting to 600. Then after subtracting variable costs, all fixed costs are deducted to arrive at net profit. The fixed expenditures are production overheads, selling expenses, administrative costs amounting to 2000, 600, 700 respectively. Thus, net income generated is 9300 which is good for Zylla Company as it is able to control upon its expenses.

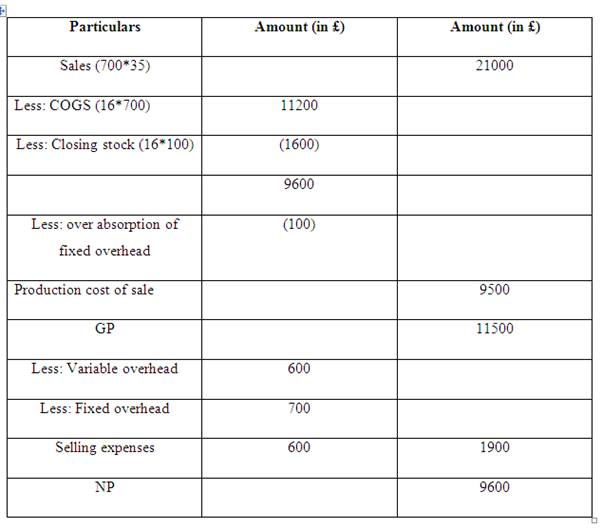

Absorption Costing income statement

It means to include all the cost incurred in the business. It is also known as “full costing” as it include both variable and fixed overhead charges in the cost of product or the operations This most common and traditional method use to ascertain the cost of product. It is also known as “full costing”. Absorption costing calculation is carried out by effectively absorbing overheads. Various manufacturing costs are absorbed by this technique. It can be interpreted that sales revenue achieved by the company is 2100 having 600 units at the rate of 35. On the other hand, cost of production is 11200 which can be further bifurcated as 700 units at rate of 16. The closing stock is 1600 and accounting to fixed production overheads is 100. Thus, total cost of production is 9500 and as such, contribution per unit is 11500. On the other hand, variable cost of 600 is deducted. Furthermore, all fixed costs are deducted such as selling and administrative ones. Thus, profit arrived is 9600 which means that Zylla Company has gained good net income after effectively absorbing manufacturing expenses (Turner and et.al, 2017).

Range of management accounting techniques

There are various techniques which are helpful to the organisation to improve upon its performance. Among this is cost variance which is the difference between actual and planned costs. It can be said that such technique is helpful for producing financial documents quite effectually. Another technique is revaluation accounting which implies that revaluation of assets is done so that book value and market value can be adjusted. This help Zylla Company to effectively prepare financial documents.

P4 Different types of planning tools and merits and demerits

The various planning tools and advantages and disadvantages are listed below-

- IRR-

IRR (Internal Rate of Return) is another effective method used to judge potentiality of the investment in effectual manner. It is uses discounting rate which makes NPV (Net Present Value) of cash inflows of new project to zero. This means that return that will be generated from internal operations is carried out by this planning tool. Higher the IRR, better for Zylla Company to invest in the project (Fourie, Opperman, Scott and Kumar, 2015).

Merits

- One of the main advantage of IRR is that it takes into consideration time value of concept in effective manner. Moreover, it analyses cash flows that will generate internal returns.

- Another merit of this planning tool is that calculating IRR by taking discounting rate is an easier task to be accomplished. Thus, potentiality and effectiveness of project can be judged with much ease.

Demerits

- The main disadvantage of IRR project size is not taken into account. Thus, cash flows are analysed and compared with the capital invested in the new project.

- IRR is not suitable as future expenditures are not focused at all. This method only takes into account present value.

- NPV-

NPV is one of the commonly used planning tool by the business in order to judge how much profitable is the new project (Maher, Fakhar and Karimi, 2018). This means that profitability aspect of project is analysed and as such, firm is able to take decision whether investment should be made or not. Higher the NPV, better for the organisation as investing in project is worthwhile. NPV is difference between cash inflows and outflows for a particular period.

Merits

- One of the main advantage of NPV is that time value concept of money is considered while evaluating profitability aspect of the project.

- It is useful as cost of capital and risk associated while making estimations regarding future is ascertained in effective manner.

Demerits

- It is disadvantageous as it relies on discounting rate which is difficult to ascertain. Moreover, projections on such basis may lead to inaccurate decisions.

- This method is not useful as cost of capital is obtained with much of guesswork and as such, results drawn on this basis may outweigh good investment and wrong conclusion can be drawn (Quattrone, 2016).

- Forecasting- It is effective planning tool as it is used to predict future sales of entity.

Merits

- Predicts future sales in effective way.

- Expenditures can be analysed easily.

Demerits

- Dependent on judgement of experts which are not correct sometimes.

- Proper analysis cannot be accomplished as it is based on assumption

- Variance analysis – It is used to figure out deviations between planned and actual results.

Merits

- It is useful and simple to analyse variances

- Corrective action is taken for improvement

Demerits

- It takes lot of time to assess differences

- Routine work is hampered of personnels and productivity is reduced.

- Standard costing- It is used to take difference between actual and expected costs if any.

Merits

- Cost variances are removed instantly

- Reduction in cost can be attained.

Demerits

- It is difficult to carry out variances

- It is time consuming technique

Use of various planning tools

The planning tools such as zero-based budgeting, NPV and IRR are effective planning tools which are helpful in preparing forecasts and budgets. Zero-based budgeting help to prepare budget from scratch base and as such, no historical figure of previous budgets are taken and as such, fresh budget is prepared. This planning tool is widely used in the business to formulate budget. Moreover, IRR is used to test potentiality of investment so that project may be analysed whether adequate returns will be generated by investment or not. On the other hand, NPV is widely used to check whether new project would be profitable for the firm or not. Moreover, concept of time value of money is utilised by NPV. Thus, planning tools are effective way to forecast budgets.

P5 How management accounting system used to respond to financial problems

Financial problems can be easily resolved by Zylla Company by taking into consideration management accounting systems. These are described below-

- Balanced Scorecard-

The balanced scorecard is one of the effective system to respond to financial problems of firm (Renz and Herman, 2016). This system measures viability of internal functions and as such, external results can be generated in the best possible manner. If external outcome is not good, feedback is provided to company to improve upon and strengthen internal functions for desired results. With the help of this system, improvement is done which is effectively strengthens organisation's internally and as such, financial issues can be resolved in effectual way.

- Budgetary target-

The budget is prepared in order to attain planned output in the best possible manner. This help company to attain stated targets in effective way. Budgetary target is an prediction of amount of resources that would be needed to perform future tasks with much ease. In relation to this, expenses to be incurred are also listed in budgetary target and as such, financial goal is prepared in anticipation of expenses and how much profit will be garnered by the company. Thus, it helps Zylla Company to effectively respond to financial problems.

- Benchmarking-

Benchmarking is another useful method which can initiate improvement of the firm and financial issues can be resolved up to a high extent. This is a method by which industry' best performing organisation may be assessed by the firm (Tappura and et.al, 2015). The practices, rules and strategies can be followed by Zylla Company so that it may be able to implement strategies of best performing organisation and as such, improvement can be done in effective manner. Moreover, financial problems could be easily resolved because of benchmarking. Thus, firm is benefited by such system of management accounting. It can be said that organisation is able to improve upon its financial condition with much ease.

- Key Performance Indicators (KPI)-

KPI is useful management accounting system which is used to assess performance of workers. This means that organisation ascertains whether employees are performing as per stated targets or not. By implementing this system, Zylla Company easily assess employees who are efficient enough and productive as well. Thus, performance is analysed and funds are diverted from unproductive to highly productive and efficient workers. Hence, by this KPI is used to adapt to financial problems with much ease (Helden and Uddin, 2016).

- Financial governance-

Financial governance is termed as the set of processes, rules and duties which are to be performed by the top management so that company may be able to resolve problems in effective manner. The duties are assigned to personnels who possess relevant abilities, capabilities so that they can manage Zylla Company quite effectually. This is crucially required as without capable management team, company cannot flourish and operational tasks would be completely wasted and no outcome would be achieved because of improper management. Thus, financial governance help to respond to problems.

Management accounting system leads to organisation success

The management accounting system is effective way which leads organisation to success with much ease. In relation to this, cash flow statement should be prepared by the company so that cash generated and utilised in various activities could be utilised in effective way (Wouters and Kirchberger, 2015). The activities of cash flow statements are operating, investing, financing which provides clarity about cash position of company. Thus, by analysing activities, operating expenditures can be reduced so that production may be injected. Hence, this system leads organisation to success. Moreover, management accounting provides way to carry out better decision with the help of financial information supplied to the management.

Set in Motion the Plan for Exemplary Grades with Our Extensive Academic Writing Services

Premium Assignment Services

CONCLUSION

Hereby it can be concluded that organisation may be able to take better and effective decision with the help of financial information provided by the financial accounting. This help management of company to take decisions so that internal functions may be strengthened in effective way. Moreover, various types of management accounting is helpful in ascertaining performance of company and as such, better decision can be taken with much ease. On the other hand, marginal and absorption costing are useful technique to analyse expenses and initiate control over the same leading to more profit. Furthermore, planning tools discussed are quite useful to Zylla Company so that it may be able to take structured decision with regards to new project. Management accounting systems are also useful for organisation so that financial problems could be resolved in effective way. Thus, management accounting information is much beneficial to organisation.

REFERENCES

- Aykan, E. and Aksoylu, S., 2013. Effects of competitive strategies and strategic management accounting techniques on perceived performance of businesses.Australian Journal of Business and Management Research.3(7). p .30.

- Burritt, R .L., Schaltegger, S. and Zvezdov, D., 2011. Carbon management accounting: explaining practice in leading German companies.Australian Accounting Review.21(1). pp.80-98.

- Cadez, S. and Guilding, C., 2012. Strategy, strategic management accounting and performance: a configurational analysis.Industrial Management & Data Systems,112(3), pp.484-501.

- Englund, H. and Gerdin, J., 2018. Management accounting and the paradox of embedded agency: A framework for analyzing sources of structural change.

- Fourie, M.L., Opperman, L., Scott, D. and Kumar, K., 2015.Municipal finance and accounting. Van Schaik Publishers.

- Lachmann, M., Trapp, I. and Trapp, R., 2017. Diversity and validity in positivist management accounting research—A longitudinal perspective over four decades.Management Accounting Research.34. pp.42-58.

- Leotta, A., Rizza, C. and Ruggeri, D., 2017. Management accounting and leadership construction in family firms.Qualitative Research in Accounting & Management.14(2). pp.189-207.

- Maher, M.H., Fakhar, M.S. and Karimi, Z., 2018. The relationship between budget emphasis, budget planning models and performance.Journal of Health Management and Informatics.5(1). pp.16-20.