Task 1: Financially sources

A.) Unincorporated Business

Regularly, the principal check originates from a family member or a friends. In principle it is a considerable measure less demanding to close them since they definitely know you. By and by in some cases this is clumsy, and may prompt to unbalanced circumstances later on. Think deliberately before taking cash from family and friends (Connolly, 2006). Each circumstance is distinctive. Something else is that loved ones may not plainly comprehend the risk and how new companies function. Set aside the opportunity to instruct them, and on the off chance that they get it and still need in then you are all evident.

Increase Your Odds of Success With Our

Bootstrapping.

Self-subsidizing from your funds (in the event that you have it) is constantly favoured. Focal points: no time going cap close by to financial specialists and you don't need to give up any control in your organization. For additional on the best way to bootstrap, look at Bootstrap Business by Rich Christiansen, who has propelled about 30 organizations by that technique.

External sources

Advances or loan extensions.

If the organization needs just a transitory or little imbursement of cash, strive for a Small Business Administration advance (offered at a lower loan cost since it is ensured by the legislature) or a bank loan extension. Cautioning: Commercial banks are regularly pretentious of new businesses unless you have individual security at risk–say, your home.

Focus on a noteworthy client.

A few clients would take care of your improvement costs keeping in mind the end goal to have the capacity to purchase your item before whatever remains of the world can (Dlabay, 2007). Their preference: control over your generation procedure (to ensure it meets their prerequisites and the guarantee of committed support. Indeed, even substantial organizations look to their best clients to subsidize new projects–this is the pith of good business improvement.

B) Incorporated business

Retained Earnings

Retained Earnings are a simple source of internal financing to utilize in light of the fact that they are fluid Assets. Retained Earnings are the part of net income that you have held in your organization and not paid out. In an independent company, Retained Earnings are generally paid out to the proprietors, who regularly don't draw a planned compensation. Rather than income in out held income, you can reinvest them into the organization.

Current Assets

Current Assets comprise of cash or anything that can undoubtedly be changed over into cash. For instance, if your business has stock ownership s in different organizations, you can strip yourself of those stocks and utilize the returns as a source of financing. You ought to be cautious, be that as it may, not to diminish your present Assets for levels not as much as your present liabilities, as this may keep you from income in off your debts.

Settled Assets

Settled Assets are those that are not effortlessly changed over to cash. Regularly, these advantages incorporate hardware, property and industrial facilities. Since these advantages set aside opportunity to change over to cash, they can't be depended on for here and now access to back. In the event that you have room schedule-wise, nevertheless, you could — for instance — auction some gear or even property to put Assets into your business. This is especially helpful if your require statement s have outgrown some of your settled Assets for instance, in the event that you have to buy more up to date gear.

Individual Savings

Individual investment funds are the foundation of many independent companies. In the event that your business doesn't have the advantages for fund your venture, you may nevertheless have individual funds that you can add to the business (Ehrhardt, 2016). This gives a contrasting option to looking for outside financial specialists or loans and permits you to hold control over your business.

External sources

Bank Loans

One of the essential sources of external financing for independent ventures is bank loans. The organization presents a loan application to a bank, investment funds and advance or other cash related foundation. The application incorporates the reason for the advance, the sum asked for and information on the organization's financial record. The bank dissects the information, favours or decays the loan application and decides the financing cost on the advance. In the event that the organization neglects to reimburse the key and enthusiasm within the recommended day and age, the bank can guarantee any insurance the organization gave to secure the loan.

Bond Issues

Rather than applying for a bank advance, little organizations can likewise issue bonds for debt financing. For organizations required in mechanical advance statement , the Industrial development Revenue Bond (IDRB) program works with nearby govern statement offices to income for large modern undertakings. Organizations that get IDRB endorsement are permitted to issue bonds and make them accessible to private financial specialists. The organization must reimburse the central and enthusiasm on the cling to the nearby office, which dispenses the returns to the financial specialists.

Angel Investors

Organizations that would like to stay away from the liabilities that c0omes with debt financing can acquire extra capital by equity financing. One wellspring of equity financing is the alleged "holy messenger speculator." These capitalist add to enhancing the gear capital, showcasing systems and industry information base in return for little bits of equity of the objective organization. Consequently, heavenly attendant financial specialists search for organizations with high potential or more normal rates of degree of profitability (ROI).

We believe in serving our customers with the most reliable assignment help

Venture capital

Another prominent type of equity funding is Venture capital. Financial capitalist discover organizations with promising development potential and offer to put Assets into trade for a generous share of the proprietorship (Dlabay, 2007). Funding firms have admittance to the cash and aptitude many developing firms need to achieve their maximum capacity. Since funding firms convey both capital and aptitude to the business, they likewise frequently put their industry specialists in control of their objective firms.

1.2 Implications regarding using of:

A.) Financing from internal sources

Sources as different as cash and capital by family and friends to begin a business and in addition business people's finances can be essential assets for inventive business people. Private wellsprings of subsidizing are regularly basic for new businesses since information asymmetries frequently render access to back on business sectors troublesome. They can help business people acquire debt financing, alongside subsidizing from funding and business blessed messengers. Open arrangement can assume a part by setting up insolvency controls so that imaginative business people will be additionally eager to put Assets into creative organizations.

Large firms with various divisions can subsidize their development interests in one division, regardless of the possibility that another one, with held income from different divisions. For this situation, corporate central command apportions rare financing crosswise over various divisions in an inner capital market, utilizing an assortment of systems to choose what contending ventures to finance. The significance given to development exercises will be especially basic in this specific situation.

Also, the competitive business environment can affect what size of internal source of financing are accessible for development. Firms can recover the settled cost of putting Assets into improvement by offering the subsequent item at an equity that is higher than the negligible cost of delivering it. Firms utilize an assortment of methodologies to support this increase, for example, utilizing licensed innovation (e.g., patent the development), first-mover advantage.

Nevertheless, these techniques are not generally fruitful practically speaking, so if markets are exceptionally aggressive it can be hard to support an increase to take care of the cost of the improvement procedure (Industrial Systems Research , 2013). Without competition there is next to no weight to advance, yet with an excess of competition financial specialists might be hesitant to subsidize inventive action in the event that they expect that regardless of the possibility that fruitful it will be hard to catch the advantages of this achieve statement

B) External source of fund

Expanded Growth Rate

Outside financing can help your private venture develop at a speedier rate than utilizing just within assets. Development in deals normally requires extra interests in stock, records of sales and different Assets. Your inward financing can bolster this extra investment just up to a specific call attention to you come up short on cash. For instance, accept your independent venture can deal with just 15 % yearly deals development utilizing just inward supports. With outside financing, you may achieve a 25 % or higher deals development rate every year.

Aggressive Position

A business frequently needs to burn through cash on different things, for example, new innovation or item research, to stay focused. Outside financing can help with this cost s. Without outside financing, you may need to do without imperative investment s and activities that you can't manage, which can give better-subsidized contenders the high ground. For instance, without outer financing, you may depend just on referrals for new business, however with outside financing you may have the capacity to bear the cost of a publicizing effort that expands your nearness.

Yield

Outside financing doesn't come free you need to surrender something to get it. When you utilize equity financing, you give up a segment of your proprietorship stake in your organization and a share of your benefits. Stockholders can likewise vote on imperative organization choices, which can lessen your control. Likewise, banks commonly require intermittent premium income statement. In spite of the fact that they don't have ownership in your business, they have a fractional claim on your advantages until you reimburse your debts.

Included Scrutiny

Before you can acquire outside financing, you ordinarily should give an extensive rundown of information to potential speculators and loan specialists (Industrial Systems Research , 2013). On the off chance that they give you cash, these gatherings may likewise oblige you to occasionally give income statement s so they can screen their venture. Information about your organization that you already minded your own business will be open for evaluate by outside gatherings. You will probably invest extra energy and bring about added cost s to meet their solicitations.

1. Three the suitable sources of finance for Clariton Antiques Ltd.

Capital is the business term for cash acquired and utilized by an organization. It is required first to purchase the hardware a business requires to begin, however there must be sufficient accessible to income the progressing costs brought about by the organization. Development capital is cash an organization uses to income for the cost s of growing the business with the goal that it can make more deals and create a more elevated amount of benefits. Following are cheapest sources of capital which are used by Clariton Antiques ltd

Equity versus Debt Capital

Equity capital originates from the offer of proprietorship pieces in the organization. A private company may offer shares to financial specialists or convey on speculator partners to give cash in return to ownership and sharing of future benefits. Debt capital is obtained cash. A private venture can assume debt through bank loans or advances from financial specialists or proprietors. Debt capital requires general interest income statement and the possible reimburse statement of the sum obtained.

Develop Your Own Equity

The slightest costly approach to expand the equity capital in an organization is through held income. This is the bookkeeping term for benefits that are not paid out to proprietors or shareholders but rather are rather kept in the business to store operations and development (Harold Bierman, 2003). Held profit gives the advantages of expanded capital without the negatives of different types of raising capital. Reinvesting a bit of business benefits permits an organization to keep on growing without acquiring cash or offering shares of ownership.

Private venture Growth Factors

For private venture, holding profit might be an intense decision for the proprietors. Most private ventures are go through organizations for assess statement purposes, so proprietors will income imposes on the benefits, regardless of the possibility that some of those benefits are not paid out as profits or benefit dispersions. Likewise, financial specialists regularly need an arrival on their cash, so the overseeing ownership may need to offer holding income to give future development of benefits, which will profit a wide range of proprietors.

Want to Join the Circles of

HIGH ACHIEERS?Make it a reality with our EXPERTS

Order NowTask 2

Analyse the costs of the two sources of finance under consideration

Chief finance executive has briefed some sources of fund after seeing the occurrence of Clariton Antiques Lt.First is the to hire the capital from outside sources at the rate of 10% interest for 5 years or second to hire the capital from the business as 0.5 million for 20% stake. Share capital of the business is one hundred fifty.All the sources from which capital can be raised has it’s own method,income statement and instructions for business.In case of changing the cost of the undertaking company is like in starting the loan income statement is 2% and further it is dependent upon the conditions of trade subjects as per the skill.As after completion of first 365 days .ten thousand pounds of interest cost will be paid before assess statement of £470000 out of normal advantage without harming the cash position of the business.

2.2 Defining the importance of financial planning for Clariton Antiques Ltd

Cash Manage statement

Many organizations have Monthly or occasional changes in incomes, which convert into periods when cash is abundant and times when cash deficiencies happen. In building the budgetary arrange statement; the proprietor considers these cycles to keep a tight rein on consumptions amid the figure low income periods. Poor trade administration can come about out negative results, for example, not having the capacity to make finance. Having a budgetary arrangement that is organized so there is dependably a cash pad helps the entrepreneur rest better during the evening (Sarnat, 2007). The cash pad permits the business to exploit openings that emerge, for example, the opportunity to buy stock from a provider at briefly decreased costs.

Long-Range View

The cost of going for short term loan is that the proprietor may not invest enough energy arranging what should be done to develop the business long haul. The cash related arrangement , with its forward looking concentration, permits the entrepreneur to better observe what uses should be made to stay with the on a development track and to remain in front of contenders. The cash related arrangement is a plan for ceaseless change in the company.

Spotting Trends

Within a period of month an entrepreneur has a large number of options as he can’t predict which option will give the positive result to achieve the result or which option is not good or will not work. Arrangement of cash should be done through quantifiable focuses so that outcome may come in between the year. The proprietor can judge that extension of promoting uses prompted in skip the deals. How to distribute the advertising dollars by proprietor will be done with the help of slope in the offers of individual items.

Organizing Expenditures

Basic feature of growth in the company is saving the assets which can be easily converted into cash. Entrepreneur will recognize the vital uses through the budgetary arranging process, those that who achieve the fast changes in profitability, performance or market aggression apart from those who postpones until and unless they have ample cash. Biggest partnership experience this prioritization procedure opposing the advantage of proposed consumption on the cost (Sarnat, 2007).

Measuring Progress

Entrepreneurs manage many difficulties and hurdles in early stages of business. It is very hard to predict about the advances. As entrepreneur require support by seeing his ability and his genuine outcome. Cash balances are permanently rising in inspiring variable or progress of income step by step in shown by demonstrating the diagram. Proprietor takes help of cash arrangement to see the probability of chances of win.

2.3 Information regarding the assess statement will be needed while making decision on financing the takeover by

a) The partners

Partners have to go through the memorandum or articles of association in order to know about the company profit sharing ratio, capital structure (Harold Bierman, 2003). For analyzing the expressions and circumstances near income sharing partners have to audit the notice or article of relationship. ,in order to know the amount of capital that every associate can add the venture.

Venture capitalist (We Finance Limited)

Business Annual reports are regularly evaluated by the venture capitalists in order to evaluate the valuation of the company or liquidity position ,to confirm the level of chance that company bound itself to give consent of advance of 0.5 million.

Finance brokers

For evaluating the company’s overall performance there is a Finance broker in the company who keeps eye on business activity with side interest on loan and information need in venture’s income statement apart from either company is improving or getting loss in each financial year. This is a sign of feature of business appraisal of the extent of liquidity risk that is appropriate for finance brokers. The appraisal of the business performance will provide a certain level perspective of the amount of danger interface with the Business and give making advance concurrence with the business undertaking.

Set in Motion the Plan for Exemplary Grades with Our Extensive Academic Writing Services

Premium Assignment Services

2.4 Financial statements impact on Clariton Antiques Ltd if it choose to go with

Venture capitalist

Investors are in this expression that company will get the advance of 0.5 million, with 20% stake in the business, so they stopped thinking about introducing the advances in Clariton Antiques Ltd(Few, 2009).Top managerial staff of the business has lose control over venture and are assuming risk apart from the suggestion is made on cash that it will yield the profit of the business .

Finance brokers

Credit of 0.5 million at 2% APR side interest income statement are planning by finance brokers to give to the Clariton Antiques Ltd. Income and amount of partitioned will reduce as an impact on financial statement by the venture has control over its voting right. This method of credit is ideal for the organization.

Task 3

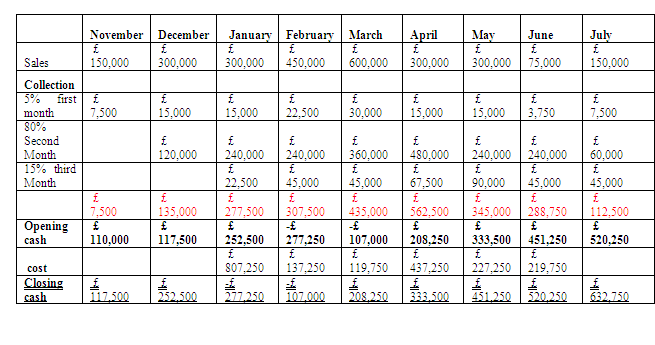

3.1 Cash budget of Clariton Antiques

3.2 Calculation of unit cost to make price decision

Activity based costing is used by company to evaluate the unit cost .Each unit has given the cost based on the hours needed by worker to complete that task.

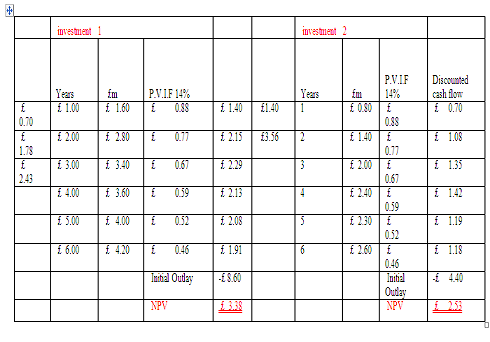

3.3 NPV investment appraisal techniques used by company to find its growth

The company will invest in investment one since the project depicts a high positive NPV unlike investment two

Income back period, period

Decision require statement s; Accept the assign statement if takes much less 3.5 years

Income back period for investment one is 1, 2 years worked out as follows

(2years+2-1.78/1.35).

From investment two, the payback period is 2.3 years which is worked out as follows

(2years+{2-1.78/1.35)=2.3

From the above table it is clear that investment one is beneficial for investment as it takes 1.3 years to regain the initial capital contributed and thus the interest will be kept in mind while financing one.

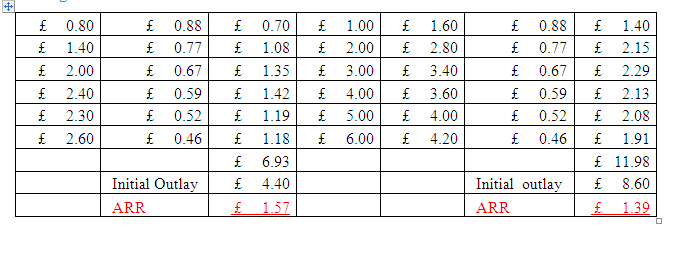

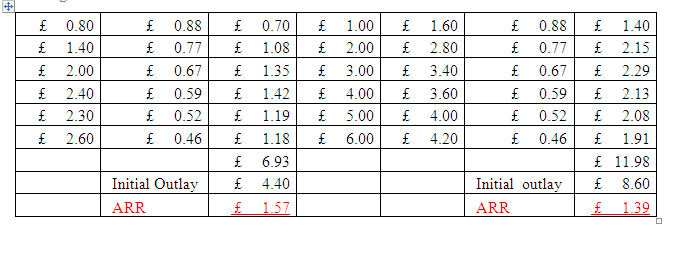

Average Rate of Return

Task 4

4.1 Key factors of financial statements

A company's incomes, gains, costs and liabilities are recorded on the income statement. Income is cash earned from an organization's typical business operations. The costs on the income statement are the expenses related with procuring the income (Vance, 2002). At the point when an organization offers one of its advantages, it can encounter a capital pick up or liability. Incomes less costs, in addition to increases short liabilities, measure up to net income or net liability.

The dollar measure of net income recorded on the income statement is likewise found on the cash flows statement under the operating activities section

Balance sheet

The Balance sheet incorporates the components of the accounting equation, Assets equals liabilities plus shareholders’ equity. The advantages on an Balance sheet are delegated either present or settled Assets. Current Assets are those assets which can be easily converted into cash over a short period of time .Settled Assets are not actually assets for some time they names assets. Current liabilities are those obligation which have to be paid or en cashed within a year. Long haul liabilities are expected in one year or later. Shareholders’ equity is the aggregate sum of equity in the firm. The shareholders’ equity section of the Balance sheets clarified in further detail on the statement of shareholders’ equity.

Cash flow statement

The Cash flow statement demonstrates the measure of cash within an organization. Items that influence the cash balance are recorded on the statement. The primary segment of the Income statement n is operating activities, which demonstrates the cash in and out of the organization in connection to its business operation. The operating activities segments additionally incorporate net income and the change in dollars of specific records recorded on the accounting report. The following section, contributing exercises, demonstrates cash the organization got and spent on an organization's capital ventures (Vikram, 2004). The financing exercises section demonstrates the inflows and surges of cash identified with the organization's issued income securities, which is likewise recorded on the Balance sheet and statement of shareholders’ equity.

Statement of Shareholders' Equity

Statement of shareholders equity shows the changes happen in the shareholder equity account. First line in account of shareholder is the opening balances of common stock, and if any stock is issued that it will be added to opening balance in order to get closing balance. Same applies to preferred stock. Next retained income which is to be recorded in balance sheets. Opening balance of net income is recorded in income statement than balance of retained profit is added to the net income and profit paid to shareholders get deducted from this in order to get closing balance(Vance, 2002). For getting aggregate shareholder’s equity closing balance of common stock or preferred stock and of retained earning will be added together.

4.2 Comparison the format of financial statements of Clariton Antiques Ltd with partnership

Balance sheet

The Balance sheet, now and again called the statement of financial position gives a preview of an organization's finance at a point in time. The Assets segment records everything with money related esteem that the organization has. The liabilities segments records all the organization's money related commit statement s (Vance, 2002). The equity segments, since its equivalent to assets less liabilities, list what the owners of the organization really "claim." There's no real distinction between the way a company presents assets and liabilities and the way a company does. The equity segment, nevertheless, is diverse in light of the fact that the ownership structures of companies and partnership are so unique.

Organization Ownership

In organizations, ownership is dispensed by stock, with each share of normal stock speaking to an equivalent share of proprietorship. On the off chance that you have a fused business with, say, 1,000 shares of stock, then each share speaks to responsibility f of 2/2,000th of the organization. For some joined private companies, all the stock is in only a couple hands. Yet, in principle, an organization could have the same number of proprietors as there are shares of stock. In an company, by differentiation, the proprietors are a constrained gathering of individuals who have chosen themselves the amount of the organization each partnership possesses. This choice is generally in light of how much cash each has put into the organization.

Corporate Equity Section

The equity section of a corporate accounting report has two primary segments: contributed capital and held profit. Contributed capital is the cash the organization has gotten from offering its stock. Once in a while these stock deals are to general society. With many fused independent ventures, nonetheless, the authors put their cash into the business and get stock consequently. The cash they put in is called "contributed capital." Retained income is the gathered benefits of the organization since it was established, less any profits it has paid to shareholders. The equity section likewise regularly reveals what number of shares of stock the organization has extraordinary. Each remarkable share speaks to an equivalent cut of the organization’s equity.

Partnership Equity Section

The equity segment of an organization's Balance sheet has a different arrangement of sections for each partnership. In a common setup, each partnership has a "capital record" and a "current record." The capital record is cash the partnership has put into the business. Benefits. At the point when the organization closes its books for a year, it decides how much benefit it made that year. It then disseminates that benefit to the partnership s' present records in view of their share of proprietorship. Each partnership’s present record is diminished by any "drawings" the partnership has produced using the organization. Proprietors are qualified for take a portion of the organization's benefits for individual utilize. When they do as such, it's a drawing, and it leaves the present record. 4.3 Interpreting the recent financial statement of Clariton Antiques Ltd using appropriate ratios and making comparison with the previous year.

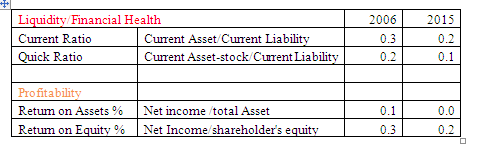

From the above analysis it is clearly depicting that business is improving its financial health. This is due to the expansion in current, proportion and quick ratio which shows that business have enough fund to pay when they fall due. Ventures are proving to be beneficial for investors as they give guaranteed returns on capital invested in company as third is predict by regularly increasing of ROE and ROA.

You may also like to read: