INTRODUCTION

Financial markets are helpful for channeling funds to the ultimate borrowers from he lenders who have enough quantum of surpluses. Present report deals with importance or significance of financial markets in the economy by which requirements of funds can be met with much ease. In relation to this, money market and capital market both are explained with their key roles and functions in effectual manner. Moreover, money market leads to influence asset prices in capital markets are explained. Different forms of EMH are explained along with efficiency of LSE. Various risks and their nature are discussed which occurs in global trade transactions and how this can be managed through forward foreign market is discussed as well. Key functions of Eurocurrency market and importance in trade transactions is enumerated in the report. Furthermore, terms related to financial market are discussed along with need for regulating financial market. Thus, it can be said that these markets are utmost vital in international level as it help to achieve economic efficiency.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

MAIN BODY

Q1 A) Difference between different levels of market efficiency

The Efficient Market Hypothesis (EMH) is quite useful for analyzing the current share prices of the company in the market in effective manner. It incorporates all the relevant information which help investors to easily analyze share prices of the firm in the best possible way (Baharumshah, Slesman and Devadason, 2017). There are basically three types of EMH such as weak, strong and semi-strong which can be distinguished below-

|

Weak |

Strong |

Semi-strong |

|

1. This form of EMH means that stock prices of company in current scenario and as such, it reflects past prices and is based on historical data. |

1. The form of EMH states it is effective to assess share prices as both information available to public and privately held information is provided as well (Slabinski. 2016). |

1. Semi-strong form states that only information which is imparted to use by public is provided to the investors |

|

2. This is weak form of the company as it has no technical analysis of the market can be used to assist investors in taking effective decisions. |

2. This is termed as strong form as all the necessary information is listed of public and private information and as such, these are accounted for current share prices. |

2. It has only public information and no private and as such, technical analysis cannot be used by investors for taking decisions. |

|

3. The weak form states that all information such as publicly held and private is not included than investors cannot assess share prices of the company. |

3. It is strong as private information such as future earnings prospectus, new products and legal issues related information and public one is also included by which investors can assess current market prices of stock in the best possible manner. |

3. It incorporates public information such as financial statements, income earnings report etc. are only provided in current stock price. Thus, shareholders cannot attain price of shares and technical analysis cannot be performed. |

|

4. This type of form is weak enough as historical data is taken into account and as such, current prices cannot be ascertained in a better way (Jermann, 2017). |

4. This form is applicable mainly where there is perfect market. It is not possible when restrictions on trading are present. |

4. Fundamental analysis cannot be possible as only partial information is available by which decisions cannot be made in effectual manner. |

|

5. The example of weak form is that just because Marks & Spencer’s (M&S) have 30 day down share price does not imply that share price will raise or not in the future. Here, historical data is gathered which classifies as weak form of EMH. |

5. Example of strong form is that private information such as equity shares’ offering which only top management has the access is incorporated in the stock price. |

5. Example is that partly information of public such as financials and partly private includes when firm releases income and as such, shares prices changes in after trading hours (Lin, Sun and Yu, 2018). |

The EMH was developed by Eugene Fama who stated that shares are traded in the market at fair value. Thus, investors cannot make technical analysis and as such, they face dilemma either to buy under valued shares or sell the same at highly inflated prices. Thus, investors have no choice but to make riskier investment.

B) Critical analysis of efficiency of London Stock Exchange

London Stock Exchange (LSE) is one of the largest and oldest stock exchanges operating since 300 years ago. It has admitted more than 3000 companies from several countries for the purpose of trading. Thus, it is well-structured stock market and important financial institution among other bigger stock markets. The efficiency of LSE can be seen that there are various high performance companies which are producing good quantum of profits in the country. Moreover, firms are competing with another in order to attain greater market share in the best possible manner. The EMH clarifies whether market is weak, semi-strong or strong which are three forms of EMH market. These have already been discussed in above paragraphs. Weak form is that future stock prices cannot be predicted by seeking the historical data and as such, technical analysis cannot be possible. Investors are not able to take decisions in effective way. Semi-strong is the one in which information is made publicly available and investors can analyze current share price. On the other hand, strong form means that there are both public and private information incorporated in stock price and reflected after trading hours to investors to effectively analyze the same (Barucci and Fontana, 2017).

In relation to EMH, theory on financial market named as APT (Arbitrage Pricing Theory) can be explained. The theory implies that it is asset pricing model means that return on asset can be estimated by utilizing relationship between such asset and risk factors. This means that risky asset expected return is provided by APT theory which is opposite of CAPM (Capital Asset Pricing Model) which is based on the market expected return. Thus, risk related to asset can be evaluated with the help of APT theory. M&S Company which is the biggest firm in UK listed on LSE has good market capitalization and as such, investors are attracted towards the firm for making investment and earn higher returns in the best possible manner.

Figure 1 M&S Company

The above stock chart shows that performance of company is overall good. For testing market efficiency of company, daily historical share price indices are taken. There are 120 observations made during the period from 3rd January 2017 to 23rd June 2017. This means that 120 days of share prices were made in this analysis of M&S Company. It can be observed from the chart that there are various high and low points in the same of historical stock prices. The four high points are 386.3, 386.9, 389.3, and 393.4. These were the high points observed on the closing of trading of shares on daily basis in the period. On the other hand, low points were 330, 323.4, 323.8, and 325.5. Thus, it can be analyzed that highest point was 393.4 and lowest was 330 n which share prices of the company was attained. This means that stock price hiked up to 393.4 and fallen down to 330 in the period of observations done in this context (Domowitz, 2018).

The performance of company is increased without many ups and downs in the market. This shows that LSE is efficient enough in accordance to EMH and as such, it can be said that performance of firm is maximized in the observation period as stock price which was declined, again hiked to much extent and as a result, LSE is efficient. The efficiency of the exchange can be made on this behalf as it is able to regulate markets in effective manner by which companies are able to perform as per the desire of shareholders in the best possible way. Moreover, more potential investors are attracting towards high performing companies such as M&S Company and as a result, higher returns are garnered by them because of the desired earnings generated by company with much ease (Van der Sterren, 2017). Furthermore, share prices of M&S Company had not drastically fallen. It had picked up pace within short time duration without affecting overall efficiency of market. Thus, it can be said that LSE is highly efficient stock exchange.

Figure 2 GBP/USD Exchange rate

It can be interpreted that GBP has gone high up to 1.5417 in comparison to USD.

Figure 3 Euro to Dollar

The Euro is also hiked in recent years as depicted by the graph.

Figure 4 UK Inflation rate

It can be interpreted that UK inflation rate has been gone down which is good for the country.

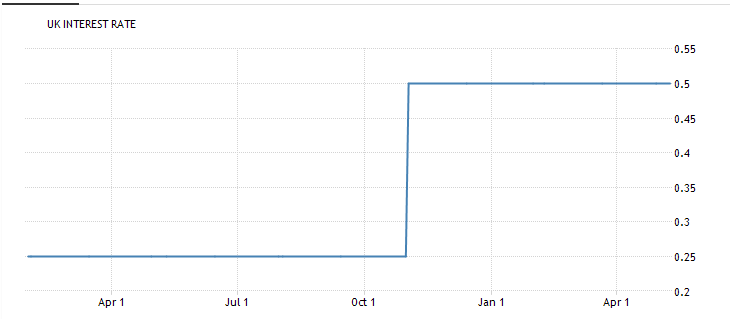

Figure 5 UK Interest rate

It can be interpreted that interest rate has come to 0.5 % as sharp slowdown has observe in overall GDP of the nation.

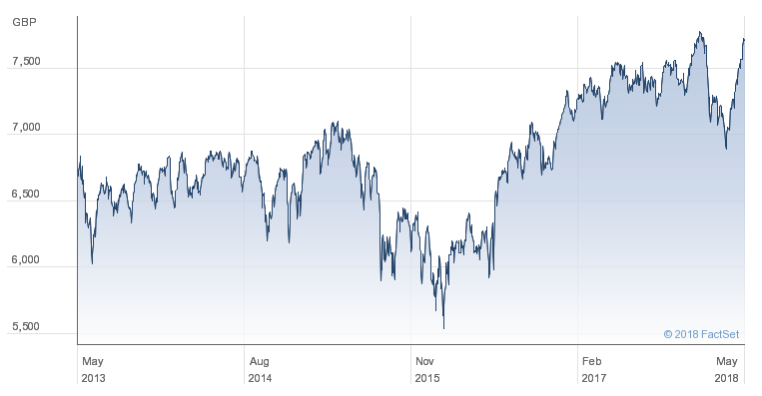

Figure 6 FTSE 100

The above graph shows that FTSE 100 listed companies are performing good as recent five years, market capitalization has increased up to a high extent.

Q2 Compare and contrast role and functions of the capital markets over money markets. Discuss how an activity of money market influences asset prices in capital markets.

The business requires finance so that it may meet its financial needs in the best possible manner. It is important for company to raise amount in order to attain finance for carrying out its daily activities in effective manner. M&S Company also requires funds so that it may be able to perform well and achieve its objectives. Capital market has the main role to raise funds by issuing securities. This market helps investor to attain higher dividends by investing in the securities of the company. Capital markets satisfy needs of lenders and borrowers. Another function of this market is that funds can be raised by issue of shares, debentures or bonds. Moreover, foreign funds can be flowed through foreign investment which channelizes foreign inflows of money in the best possible manner (Du and Zhu, 2017).

On the other hand, money market is known as the market where short-term requirements of money are traded. This clearly shows that major role of this market is to firm raises money to meet short-term needs. The function of money market is that to effectively maintain balance between supply and demand of monetary transactions. Another function is to discount bills of exchange helping in injecting trade growth in the best possible manner. Next function is short-term financing help to produce short-term savings as well. This market help to impart funds to developing sectors which requires adequate liquidity position for carrying out activities with much ease. Another function of this market is that implementation of monetary policy is based on the activities of money market. This means that it is a base for formulating and initiating monetary policy by the government in effective way (Balduzzi, Brancati and Schiantarelli, 2017).

The money market activities influences asset prices in the capital markets. There are various asset prices such as loans, equity prices, property prices etc. These prices tend to change when money market affects these assets. The monetary policy which is prepared by the government is highly influenced by money market. The capital market asset prices consist of equities, shares and related securities. Investors’ expectation such as speculative or rational is the main driving force in the capital market which eventually influences asset prices in relation to future development of economy which automatically affects NPV (Net Present Value) of return on assets in the future. This is evident from the fact that capital market asset prices are changed by long-term expectations of investors and also economic development is done (Armour, Mayer and Polo, 2017). This affects and influences changes in level of productivity, inflation level, interest rates and taxation policy to name a few. Moreover, if liquidity of the business reduces up to a high extent, then due to lack of liquidity, credit instruments in the capital market gets affected and it gradually influences asset prices. Thus, it can be said that money and capital market are part of financial markets and when monetary policy is changed, interest rate also undergoes changes which eventually leads to influence prices of asset. Hence, money market is quite correlated to capital market.

Instruments of capital market

Debt- It is used by M&S to effectively meet requirements and interest is paid along with principal amount.

Equities- In secondary market, it is issued by firm and carries more risks and generates high returns.

Characteristics of capital market

Long term investment- It is for long-term requirement of funds and cannot deal in funds less than one year

Capital formation- activities will assist in evaluating capital formation rate of particular economy.

Participants of capital market

The participants are local or state governments, organizations and individuals.

Characteristics of money market

Liquidity- They have maturity period of less than one year.

Higher safety- It is achieved as issues have more credit ratings.

Price discount- Issues are made on comparative discount which is less than face value.

Instruments of money market

Treasury bills- These bills are of short-term liabilities matured within one year and controlled by UK government.

Commercial papers- It is a type of unsecured promissory note of short-term basis usually issued by firms.

Participants of money market

Commercial banks, state government, companies are participants of this market.

UK Bond rate

It can be analyzed that lines are increased at initial stage ion 2014 and decreased in 2017 and again rising in 2018.

Housing Price in London

The average housing prices have gone to increase by 68 %. Rents have increased after 2011 and much in 2016.

Q3 A) Discussing nature of potential risks in global transactions and explaining how international traders manage risks

The nature of potential risks in the international transactions are more because it is based on various parameters such as foreign exchange risk, political risk, economic risks and many other as well. It can be said that these have immense danger to international investors and traders who have their operations in the abroad and as such, it affects them. Foreign exchange danger arises because of constant changes occurring in the currency (Black, Devereux, Lundborg and Majlesi, 2018). This risk prevails when value of domestic currency depreciates leading to decrease income in abroad. On the other hand, political risk is of the nature that government makes changes related to taxation policies, implementing trade barriers, then international transactions cannot be made and there is a risk with respect to such policies. Economic risk means that insolvency of buyer may prevail; concession risk in the context of economic control may be present.

The risks can be managed effectively with the help of forward exchange markets. The term forward market means that it is an over-the-counter (OTC) place that effectively sets the price of assets or any instruments in financial terms for delivery in the future. This means that if risk prevails in the foreign this market if have no influence from government, then supply and demand is the mechanism for regulating forward market. The foreign exchange risk is managed with much ease as it helps to eradicate uncertainty over expenses of receipts and payments in future foreign currency (Calvet, Grandmont and Lemaire, 2017). They are helpful for international traders as they have flexibility and as such, it can be extended in the future either by purchasing contract or structuring such option.

Uncertainty appreciation period

It is assessed unlimited gathered which is behind at particular period

Fluctuation period

Overvaluation can be seen as more variations occurs and organization will start facing the same.

Depreciation period

Total assets available for making allocation of capital. Thus, location and situations are required for operating easily.

B) Discussing functions and operations of Eurocurrency market and importance of this market in trade transactions

The Eurocurrency market is effective currency which is kept by the banks outside of the particular nation where the same is regarded as a legal tender and as such, it is borrowed and lent money in foreign currencies. The currency is not the native one of the nations in which bank is situated. Moreover, it is type of money market in which currencies can be borrowed and lent to other countries and are freely convertible as well (Pouget, Sauvagnat and Villeneuve, 2017). The main function of Eurocurrency market is that medium term funds are effectively transferred from one nation to another. The funds lead to expansion whenever deposits are made by residents of US or banks, by central bank of the nation. The operations of Eurocurrency market is that global capital markets can be effectively integrated with one another and flow of funds can take place in the best possible manner. These flow of resources have quite initiated improvement in achieving efficiency of various world economies as money is channelized in a better way.

The importance of Eurocurrency market in conducting international trade transactions is that it has helped economies which have been in deficits in balance of payment and as such, surpluses are passed or channelized to weak economies and as a result, foreign currencies are lent and thus, financing needs or requirements can be met with much ease. Recycling is made by which surplus amount is passed to deficits in terms of balance of trade and payment. Thus, Eurocurrency market is useful in carrying out global transactions. Moreover, liquidity problem can be effectively resolved by the countries running in such adverse situation and thus, it is useful in making transactions possible internationally.

Figure 7 UK US exchange rate

The exchange rate has come down in the recent couple of year as depicted by the UK US exchange rate graph.

Figure 8 EURO US market

The EURO US market is hiked as depicted by the graph within the span of three years and roused in 2017 up to a high extent.

Q4 A) Explaining various terms related to financial markets

A) Asymmetric information

Asymmetric information means that one party knows more knowledge than other party particularly in an economic transaction in the best possible manner. In simple words, sellers have more material knowledge in comparison to buyers of the product. It can be said that this situation applies to all economic transactions it contains information failure or asymmetries. In relation to this, financial advisors have greater knowledge as compared to investors. Thus, they can provide advices to clients in which stock they should invest to get higher returns (Kosfeld and Schüwer, 2017).

B) Moral hazard

This means that a party which is protected from any type of risk will behave differently than if the same has no such protection. This implies that moral hazard prevails when party to a economic transaction has not act good in faith and as such, party has provided false information about the assets or liabilities. Thus, this risk occurs whenever there is an agreement made between two parties. The same applies to the financial market as well where borrowers and lenders meet in the market (Arthur, 2018).

c) Adverse selection

Adverse selection means that buyers have less knowledge as compared to sellers and as such, they are at disadvantage because they do not know the same. It can be said that adverse selection is made as investors do not have much knowledge about the stock market. Thus, negotiation is attained as one party has more information as compared to other party (Daniel, Neves and Horta, 2017).

There is need for regulation of financial markets so that funds can be availed by borrowers. The financial markets comprises of money and capital markets by which borrowers and lenders meet in order to exchange funds in the best possible manner. The short-term requirements can be easily met and as such, long-term requirements can be met with the help of financial markets. This is evident from the fact that firm is able to garner funds in effective way. M&S Company can easily attain required funds by raising from financial markets and operational activities may be accomplished with much ease (Vayanos, Eyster and Rabin, 2018). Since, funds are mobilized from those who have surpluses and those who are in shortage of the same; there is a need for regulating this market. Regulation is needed as adequate protection from any type of harm can be provided to the customers who deal in such markets. This helps them to protect against any markets where competitive forces are not strong. As such, customers are provided safety through regulation by protecting them from any economic harm in the best possible manner.

Government initiates control forces of supply and demand which means that what prices need to be quoted and who should enter financial market with much ease. Thus, it is quite needed for regulating financial markets in effectual manner in order to protect customers from any unintended economic harm (Mandes and Winker, 2017). A financial regulation limit and imposes certain restrictions in order to stabilize financial system quite effectually. These regulations are made and enacted by government or even non-government companies as well.

Set in Motion the Plan for Exemplary Grades with Our Extensive Academic Writing Services

Premium Assignment Services

CONCLUSION

Hereby it can be concluded that financial markets play crucial role in meeting short-term and medium term requirements of money in the best possible way. Money market is used for raising funds for shorter time and has high liquidity as it needs to be repaid within short duration. On the other hand, capital market is used for raising money by issuing shares, debentures, bonds so that requirements can be achieved by the firm with much ease. Furthermore, financial markets help to mobilize surpluses to deficits and enhancing economy in effectual manner. Moreover, EMH also plays important role in carrying out current stock price of firm. Eurocurrency market is helpful for lending and depositing in foreign currencies and useful for conducting of international trade transactions in effective way.

REFERENCES

- Armour, J., Mayer, C. and Polo, A., 2017. Regulatory sanctions and reputational damage in financial markets.Journal of Financial and Quantitative Analysis.52(4). pp.1429-1448.

- Arthur, W. B., 2018. Asset pricing under endogenous expectations in an artificial stock market. InThe economy as an evolving complex system II(pp. 31-60). CRC Press.

- Baharumshah, A. Z., Slesman, L. and Devadason, E. S., 2017. Types of foreign capital inflows and economic growth: New evidence on role of financial markets.Journal of International Development.29(6). pp.768-789.

- Balduzzi, P., Brancati, E. and Schiantarelli, F., 2017. Financial markets, banks’ cost of funding, and firms’ decisions: Lessons from two crises.Journal of Financial Intermediation.

- Barucci, E. and Fontana, C., 2017.Financial markets theory: Equilibrium, efficiency and information. Springer.

- Black, S. E., Devereux, P. J., Lundborg, P. and Majlesi, K., 2018. Learning to take risks? The effect of education on risk-taking in financial markets.Review of Finance.22(3). pp.951-975.

- Calvet, L. E., Grandmont, J. M. and Lemaire, I., 2017. Aggregation of Heterogenous Beliefs, Asset Pricing, and Risk Sharing in Complete Financial Markets.Research in Economics.

- Daniel, M., Neves, R. F. and Horta, N., 2017. Company event popularity for financial markets using Twitter and sentiment analysis.Expert Systems with Applications.71. pp.111-124.

- Domowitz, I., 2018. Automating the continuous double auction in practice: Automated trade execution systems in financial markets. InThe Double Auction Market(pp. 27-60). Routledge.

- Du, S. and Zhu, H., 2017. What is the optimal trading frequency in financial markets?.The Review of Economic Studies.84(4). pp.1606-1651.

- Jermann, U. J., 2017. Financial Markets' Views about the Euro–Swiss Franc Floor.Journal of Money, Credit and Banking.49(2-3). pp.553-565.

- Kosfeld, M. and Schüwer, U., 2017. Add-on pricing in retail financial markets and the fallacies of consumer education.Review of Finance.21(3). pp.1189-1216.

- Lin, E. M., Sun, E. W. and Yu, M. T., 2018. Systemic risk, financial markets, and performance of financial institutions.Annals of Operations Research.262(2). pp.579-603.

- Mandes, A. and Winker, P., 2017. Complexity and model comparison in agent based modeling of financial markets.Journal of Economic Interaction and Coordination.12(3). pp.469-506.

- Pouget, S., Sauvagnat, J. and Villeneuve, S., 2017. A mind is a terrible thing to change: confirmatory bias in financial markets.The Review of Financial Studies.30(6). pp.2066-2109.

- Van der Sterren, J., 2017. Financial markets, microfinance and tourism in developing countries.ARA: Revista de Investigación en Turismo.1(2).

- Vayanos, D., Eyster, E. and Rabin, M., 2018. Financial markets where traders neglect the informational content of prices.Journal of Finance.