Introduction

In the globally connected corporate world, companies started paying special attention on managing their funds. Certified Financial Manager (CFO) owes liability to procure necessary capital for running their operations and administrate it in an effective manner to attain the set goals. Planning, organizing, monitoring and controlling the monetary activities i.e. procurement & fund utilization and its effective management is called financial management. Profitability and liquidity management are the two core activities of finance manager. In addition, he also has to determine various fixed and fluctuating source of capital either long-term debt or equity capital or a combination of both to finance their long-term assets. The proposed project report emphasizes upon examining the financial performance of Marks and Spencer Group Plc with its rivalry firm, Sainsbury Plc. Moreover, lastly, it will make bond valuation of both the companies.

(A) Ratio analysis

Ratio analysis is the quantitative technique that is helpful for analysing the financial statement using distinctive kind of ratios i.e. solvency, profitability, liquidity and efficiency ratios as well.

Want to Join the Circles of

HIGH ACHIEERS?Make it a reality with our EXPERTS

Order Now1. Comment on the liquidity position using current and quick ratio

Liquidity ratios are helpful to determine firm’s ability to dispose off their short-term debt obligations & its margin of safety using current & quick ratio.

Current ratio: It determines working capital (WC) in the business through the comparison of current assets with the current liabilities. In latest year, 2016, M&S’s CR remains unchanged from 0.69:1 because of little bit changes in the CA and CL by 0.41% and -0.33%. Fewer increases in cash by 4m, inventory by 2m, prepaid expense by 10m and decline in other assets by 9m resulted decline in CA by 6m. However, CL dropped from 2,112m to 2,105m which brought no change in the liquidity position. In contrast, Sainsbury’s CR gone up from 0.64 to 0.66 because of decline in inventory and cash to 968m and 1143m. It is below than M&S’s CR which indicates that M&S has sound liquidity position in comparison to the competitor (Lakshmi, Martin and Venkatesan, 2016). In comparison to industrial benchmark, 2:1, both the firm’s can be suggested to improve their liquidity by increasing their resource availability & reduce short-term debt load. Moreover, it must monitor their accounts receivables to get prompt payments and negotiate with the vendors for the longer credit terms which help in effective cash management.

Quick ratio: It measures relationship between liquid assets with the current liabilities. In CY, 2016, M&S’s QR remains fixed to 0.31:1 whilst Sainsbury’s QR gone up from 0.49:1 to 0.52:1. High ratio of Sainsbury reflects that it has higher availability of liquid assets to dispose off their trade payables and other short-term debt (Goldmann, 2017). Idle industrial quick ratio is 1:1 which demonstrates that liquid assets and current obligations must be equal for having sound creditworthiness. Effective cash management plan needs to be designed by negotiating suppliers for extending the credit duration and receiving cash quickly from the debtors. Profitability management, reduction in overheads and reduction in unproductive assets also may drive better liquidity position (Adekola, Samy and Knight, 2017).

2. Calculation of net profit margin, ROA and ROE

M&S and Sainsbury both are profit-centric organization which aims at maximizing their net return by generating larger revenue at controlled cost so that maximum profitability can be gained.

Net profit margin: This tool measures net margin by dividing the net organizational return to the total turnover. In CY 2016, M&S’s NM dropped from 4.72% to 3.86% due to increase in cost of sales and other operational expenditures by 1.49% and 7.76% however turnover gone up by only 2.37%. High cost of selling & administration expenditures to boost sales by driving larger audiences also result in high overheads and lower return (Bibi and Amjad, 2017). In contrast, Sainsbury’s NPM converted from loss of 0.70% to 2% profitability because of decline in administrative cost by 24.91% and stronger control over the regular spending. High ratio of M&S indicates that its profitability position is good and generated good return over their sales made.

Return on assets (ROA): It measures the percentage return on total assets of the firm. M&S’s ROA grown from 5.94% to 4.80% because of greater assets and decreased net return, however, Sainsbury’s ROA moved from loss of -1% to 2.77% because of positive net earnings through controlled overheads. M&S’s ROA is approximately twice to that of Sainsbury reflecting that it gained better return on their assets (Boyas and Teeter, 2017).

Return on equity (ROE): Du-pont analysis is helpful for determining the profit percentage on total equity capital invested. It break-down ROE calculation into three different parts that are net margin, assets turnover and equity multiplier.

Dupont analysis: Net margin*assets turnover*Equity multiplier

In CY 2016, M&S’s ROE came down from 15.23% to 11.87% because of decreased NPM, assets utilization efficiency and financial leverage to 3.86%, 1.25 times and 2.46 as well. Inefficient and ineffective use of total assets by the managers to get better revenues resulted downward shifting in assets turnover (Rakićević and et.al., 2016). However, declined leverage shows that shows more equity capital in relation to the total business assets. In comparison to this, Sainsbury’s ROE shows a favourable change from 3% to 7.40% because of increase in NPM to 2%. Unlike it, assets turnover ratio came down to 1.38 times and equity multiplier to 2.67 due to repayment of long-term borrowings. Comparatively, it is higher in Sainsbury demonstrates that it has generated better return over their total equity capital invested in the corporation (Sainsbury’s annual report, 2016).

3. Calculation of capital structure ratios

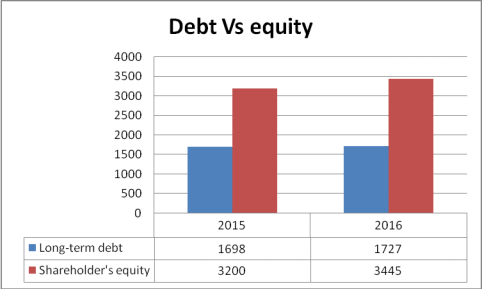

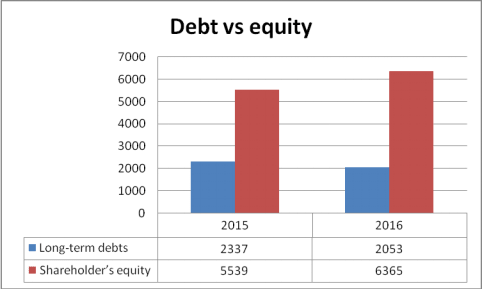

Debt to equity ratio: Capital structure deals with the longer period financial sources which can be obtained either by the borrowings and shareholder equity. Debt to equity ratio is the best one that figure out the composition of debt capital and owner’s equity to finance the long-term assets. M&S’s D/E ratio came down from 0.53:1 to 0.50:1, thus, it reached to the industry benchmark, whereas Sainsbury’s D/E ratio decreased from 0.42:1 to 0.32:1. Raising higher capital from the equity source by YOY growth of 7.66% and less borrowed capital by 1.71% reduced leverage in M&S. On the other side, Sainsbury finance manager raised money only through investors as its annual financial account reported YOY growth of 14.91% whilst 12.15% debt were repaid this year to minimize the leverage (Nelson and Gnanapragasam, 2016). Reduction in leverage mainly created with the purpose of decreasing fixed financial obligations in the terms of interest by raising money through investors for financing non-current assets.

Interest bearing ratio: This ratio is also essential to be analyze because firm can only take additional borrowings if it has enough or adequate availability of profit to pay interest on scheduled date to the lenders. In 2016, M&S’s interest bearing ratio dropped down from 4.87 times to 4.03 times because excessive overheads resulted poor return (Shukla and Roopa, 2017). However, Sainsbury’s interest bearing ratio improved from -0.92 to 2.82 times due to less interest obligations and better return worth 471m in current year. However, comparatively, M&S has high capacity to meet fixed interest obligations on time and able to take borrowings.

Now, as per the scenario, if M&S has requested a loan to satisfy their capital requirement then although, undoubtedly, it had strengthen its debt bearing ability but still as company has just reached the idle ratio therefore, it can be suggested to procure capital for longer capital using both the debt & equity instead of loan only (Marks and Spencer’s annual report, 2016). Receiving money only through debt brings into greater fixed financial burden and resulted decline in net profit margin due to heavy finance cost which will have an adverse impact on its performance. Thus, it can be recommended to the M&S to procure required fund by a combination of equity & debt to maintain their solvency position by designing a right capital structure.

4. Comment on the long-term and short-term sources of finance

| Sources of capital | 2015 (In GBPm) |

2016 (In GBPm) |

% increase/decrease |

| Long-term debt | 1698 | 1727 | 1.71% |

| Shareholder's equity | 3200 | 3445 | 7.66% |

Looking to the Marks and Spencer’s annual reports, it can be seen that under the long-term financial sources, it utilized both the debt borrowings and shareholders’ investment. In the year 2015, M&S’s total debt fund reported to 1,698m GBP which raised to 1,727m by 1.71% in the year 2016 so as to finance their non-current assets, fixture and equipments, property and plant (Room, 2016). However, on the other hand, its investor equity capital in the year 2015 reported to 3,200m which rose to 3,445m GBP by 7.66% in 2016.

| Sources of capital | 2015 (In GBPm) |

2016 (In GBPm) |

% increase/decrease |

| Long-term debts | 2337 | 2053 | -12.15% |

| Shareholder’s equity | 5539 | 6365 | 14.91% |

On the other hand, Sainsbury’s long-term debt got improved from 2,337m to 2,053m GBP decreased by 12.15%. It showcase that firm repaid their long-term debt loan in the current year to reduce their leverage and minimize finance cost. Net loss in 2015 is the main reason behind this which brings serious cash difficulty for the firm to meet out their fixed financial obligation exactly on time mentioned as per repayment schedule. Unlike it, investor’s equity gone up from 5,539m to 6,365m GBP by 14.91% which help to satisfied capital requirement of Sainsbury.

However, under the short-term source of finance, both the M&S and Sainsbury utilized accounting receivables financing, customer advances, short-term bank loans, overdraft and credit from the suppliers. It fulfilled its working capital requirement through cash credit, trade financing and bill discounting as well (Jednak, Parežanin and Kragulj, 2016). Further, outstanding customer bills have been discounted from the financial institution via using factoring so as to get cash promptly before maturity date. Besides this, outstanding expenses for which firm owed payment obligation still not yet paid retain cash to the company for repayment of their short-term liabilities on time.

Limitations of ratio analysis

Useful in only quantitative analysis and do not examine qualitative performance i.e. human talent, retention, consumer satisfaction, technological growth, competitive strength & others.

It is based on past performance analysis hence not useful in anticipating future year’s results about which investors are more concerned to make rationalized decision whether to put investment or not (Bekaert and et.al., 2016).

It is very difficult to say that a particular ratio is good or bad because target ratios are not available in all the cases. Referring above analysis, there is no standards set regarding assets utilization efficiency.

Difference in accounting policies, rules and regulations by both the companies figure out different results and may results in taking misleading decisions (Qin and Linetsky, 2017).

Ratios do not consider change in external market environment i.e. inflation and others which affect the quality of financial decisions.

(B) Bond valuation, international bond rating agencies and reasons for maintaining a given target rating

The three international bond rating agencies are Standards & poor, Fitch Group and Moody. Fitch Group is a New-York based whereas Standard & Poor and Moody’s are US based. It is essential for the M&S to maintain a given target rating on their outstanding debt, because it, direct affects the investment decisions of investors, which in turn, have an impact on long-term capital procurement. Investors wish to put their fund in the best credit rating company because of high fund security and do not invest in poor credit rating company. Moreover, it create negative brand image in the mind of investors, as a result, they will not be ready to put their capital due to high risk.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

Conclusion

Aforementioned report brings out the fact that M&S’s profitability performance is better as compare to its rivalry, Sainsbury. Moreover, it has better liquidity position still, it seems essential for the firm to employ better policies in relation to receivable payment, supplier negotiation, cash management strategies & others to reach the idle position. Besides this, its CS has just reached the standard ratio, therefore, it is considered advisable to procure more funds by a combination of both debt & equity for the sound solvency position.

References

- Adekola, A., Samy, M. and Knight, D., 2017. Efficient working capital management as the tool for driving profitability and liquidity: a correlation analysis of Nigerian companies. International Journal of Business and Globalisation. 18(2). pp.251-275.

- Bekaert, G. and et.al., 2016. Political risk and international valuation. Journal of Corporate Finance, 37(12). pp.1-23.

- Bibi, N. and Amjad, S., 2017. The Relationship between Liquidity and Firms’ Profitability: A Case Study of Karachi Stock Exchange. Asian Journal of Finance & Accounting. 9(1). pp.54-67.

- Boyas, E. and Teeter, R., 2017. Teaching Financial Ratio Analysis using XBRL. Developments in Business Simulation and Experiential Learning. 44(1). pp.15-38.

- Goldmann, K., 2017. Financial Liquidity and Profitability Management in Practice of Polish Business. In Financial Environment and Business Development. Springer International Publishing. 9(2). pp.103-112.

- Jednak, S., Parežanin, M. and Kragulj, D., 2016. Domestic and international sources of funding economic development of Serbia. Info M. 15(59). pp.4-11.

- Lakshmi, T.M., Martin, A. and Venkatesan, V.P., 2016. A Genetic Bankrupt Ratio Analysis Tool Using a Genetic Algorithm to Identify Influencing Financial Ratios. IEEE Transactions on Evolutionary Computation. 20(1). pp.38-51.

- Nelson, A.W. and Gnanapragasam, V.J., 2016. Applying for research funding. Part 1–sources of funding. Journal of Clinical Urology. 9(3). pp.201-204.

- Qin, L. and Linetsky, V., 2017. LongTerm Risk: A Martingale Approach. Econometrica. 85(1). pp.299-312.

- Rakićević, A. and et.al., 2016. DuPont Financial Ratio Analysis Using Logical Aggregation. In Soft Computing Application. Springer International Publishing. 12(4). pp.727-739.

- Room, R., 2016. Sources of funding as an influence on alcohol studies. The International Journal of Alcohol and Drug Research. 5(1). pp.15-16.

- Shukla, S. and Roopa, T.N., 2017. Financial behaviour of selected telecom companies in India: a comparative analysis. International Journal of Indian Culture and Business Management.