INTORDUCTION

In this competitive world, this can be rightly observed that the management accounting is the tool that can be used by a firm in order to gain the sustainable development. There are various tools which can be used by the organisation in order to gain the sustainability in an effective manner. Manager of the cited firm is required to adopt these accounting tools that can assist to gain the pre-set target. Management could gain the sustainable development. Now, there is a strong need to adopt various costing method that can be used by the organisation in order to optimise the profits in an effective manner (Lavia López and Hiebl, 2014). Various planning tools are implemented by the organisation in order to optimise the profits. Various accounting tools are used by the organisation in order to overcome the various financial issues.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

TASK 1

a). Explanation of management accounting and its types

MA system is the most crucial process which can be implemented by the organisation for identifying, analysing, assessing and evaluating the non-financial problems. Now, this can be rightly said that the MA systems are the best tool through which the organisation could get the competitive advantages over the others. In other words, this is the process of presentation of the accounting information for making the policies which can be considered by the organisation in order to make their routine activities. This simply means that management assist to perform whole its functions covering planning, organising, staffing, directing and controlling (Christ, 2014).

- Difference between financial management and management accounting.

Financial accounting is the MA such as the two legs of the similar human. Function of both of them is to ensure that management development toward better future. But on the other hand, management accounting is broader than financial accounting in assisting management since subject “management accounting” is formed by the organisation in an effective manner.

|

Financial management |

Management accounting |

|

Financial management concentrates on formulation of financial statements of particular business organisation that is required by different parties that are associated with that company. |

Management accounting is performed by the organisation in Order to supply all relevant and materialistic information to manager that results in formulation of effective and efficient strategy for the company. |

|

This type of management accounting is utilised by the internal and external parties associated with that company. Hence, it has broader scope. |

The main user of this accounting system is internal management and therefore, it has narrower scope. |

|

It has to be published properly as its basic aim is to deliver financial information to several users. Apart from it, these accounting system is audited by the auditors. |

Management accounting is neither published nor audited as it is of internal use, hence there is no requirement for the same. |

|

This type of accounting is framed at the end of the financial time period. |

This is conducted as per the need arises by management in the company. |

|

It is developed in proper structure and format. |

There is no proper format hence it is drawn as per the convenience of manager. |

|

This type of statements delivers information that is of monetary nature. |

This type of accounting consists of data and information that is of monetary and non- monetary in nature. |

|

The primary objective of this type of financial statement is to deliver all information to outside users that include, investors, creditors, debtors etc. |

The basic aim and objective of this management system is to help the manager to take effective decisions on number of important information (Moser, 2012). |

|

Management have to conduct this financial management regularly, thus it is compulsory for the manager to perform it. |

It is not compulsory for the management to conduct this process as it is performed as the need arises. |

|

There are certain standard and norms on which it is performed. |

There are not specific rules and regulations that have to followed by the management. |

1. Importance of management accounting: Management of the cited organisation is required to make various management accounting tools which can be implemented by the firm for achieving its pre-set targets in an effective manner (Weygandt, Kimmel, and Kieso, 2015). This is the term which is implemented to elaborates the accounting tools, systems and tools which, with special knowledge and ability, assist management in its task of optimising profits of lowering losses. Management Accounting helps management in planning and also creating policies by forming predict about manufacturing, selling, inflows and outflow of the cash. Nowadays, this can be rightly said that the management of the cited organisation in order to gain the business decisions in an effective manner. Now, this is the main tool which can be used by the organisation in order to gain the sustainability.

2. Cost accounting systems: This is the accounting system which is implemented by the organisation in order to make the production of the goods. Now, there is a strong need to adopt this by using this tool in an effective manner. Cost accounting system is the crucial tool which can be implemented by the cited organisation for making the organisation objectives in an effective manner. With the help of this, organisation is planning to implement its objectives in an effective manner so that the business in an effective manner. Cost accounting systems are further categorised into actual, normal and standard costing which are further elaborated under this.

Actual costing: this is the recording of the product costs which are totally relied upon the following factors: Actual cost of labour, Actual overheads costs occurred, allocating implementing actual quantity of the allocation base experienced at the time of reporting period.

Normal costing: This is implemented to value manufacturing products along with actual material costs, actual direct labour costs and manufacturing related overhead which are totally relied upon the forecasted production overhead rate. These three costs are related to the product costs and are implemented for the cost of goods sold and for inventory valuation.

Standard Costing: This is the practice of substituting forecasted cost for an actual cost in the accounting records, and then periodically recording variances which reflects differences between the forecasted and actual costs.

Inventory management system: This is the main tool through which inventory is managed in an effective manner. Now, this is rightly observed that the management of the cited organisation is required to adopt inventory management system which would help out to gain the sustainable development. There are mostly three methods which would help out to manage the inventory in an effective manner. some of them are mentioned hereunder:

FIFO Method: This is the method under which inventory which is firstly placed is to be considered at the time of calculating the inventory (Leitner, 2013). However, this can be rightly said that the management of the cited organisation is required to optimise the inventory in an effective manner. In this, costs which are assigned to those goods which are the costs for first product brought.

LIFO Method: This is the method which consider all the last items which were introduced are the first items to be sold. This cited method said that last inventories purchased are first ones to disposed of. This tool assumes that last stocks introduced which are firstly one to be sold, and that stocks bring first are sold last.

Weighted Average Method: This method is basically implemented in the production organisations where stock is piled or mixed together and cannot be differentiated, like raw material and so on.

- Job costing system: This is the main system which is used by the management in order to gain the objectives in an effective manner. Although, this is the system for assigning production costs to an individual good or batches of goods (Akbar, 2010). Normally, this is implemented only when organisations produced which are sufficiently different from each other.

- Batch costing: It is known as of the specific form of particular order costing. It is more similar to job order costing which is have data of manufacturing on it.

- Process costing: It is said to be reliable term used to cost accounting that describe single method for collecting and producing cost to an individual units produced.

- Contract costing: As per this tracking of cost related with a particular contract with the client. It is mainly used for the large construction work.

- Service costing: It is considering as one of the type of operation costing that is used in an organisation which would provide services irrespective of manufacturing products.

B) Presenting Financial information

- Diverse kinds of managerial accounting reports:

There are so many repots which are used by the organisation for gain the sustainability. However, this can be rightly said that the management of the cited organisation is required to adopt various options that can be help out to get the competitive advantages. There are some of the budgets are mentioned hereunder:

Budget reports: This is the reports which is made on the basis of specific revenues and expenses for a certain period of time. However, this can be rightly said that the management of the cited organisation is required to adopt budget as per the organisation needs. This is needed to be done as per the management that can help out to form the business objectives accordingly. With the help of this, manager can evaluate the actual and forecasted figure accordingly.

Account receivable aging report: This is the report under which unpaid consumer invoices and unused credit memos are to be recorded in an effective manner. The main aim is implemented by gathering personnel in order to identify which invoices which are overdue for payment. The report is like implemented by management to identify efficiency of the credit and gathering functions.

- Importance of Management accounting information:

This various management accounting information are so much crucial as these all assist in gaining the sustainable development in an effective manner (Eierle and Schultze, 2013). management accounting information are used by the cited organisation for gaining the sustainability in an effective manner. this management accounting information would help out to gain the sustainable development in an effective manner various management accounting systems are used by the managers in order to get the sustainability efficient manner.

M1

There are so many tools which can be used by the organisation for making the business objectives in an effective manner. Management Accounting systems are used which could be implemented in order to gain the sustainability in an effective manner. On the other way, this is the most efficient tool which would help out to form efficient tool that would help out to gain the sustainability effectively and efficiently.

D1

Management accounting systems and reporting is integrated throughout firms’ process. This can be rightly said that the management accounting systems are the most effective tools which would ultimately help out to make various reports that could assist to integrate in an effective manner. now, there are various management accounting systems are used by the cited organisation in order to integrate the MA systems to the MA reports.

TASK 2

Cost is the most important aspect for a firm that are linked with the manufacturing of goods and services. This is totally linked to the organisation There are so many kinds of the costs which are linked to be considered. Few of them are elaborated as under:

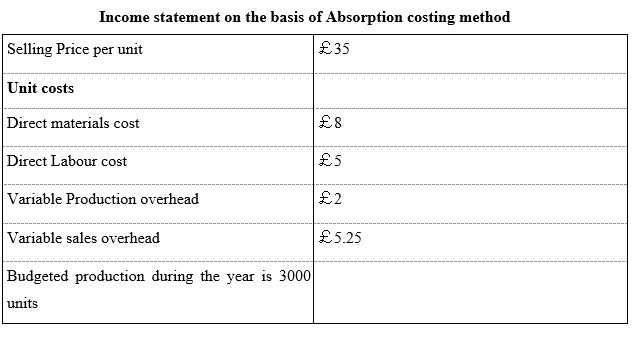

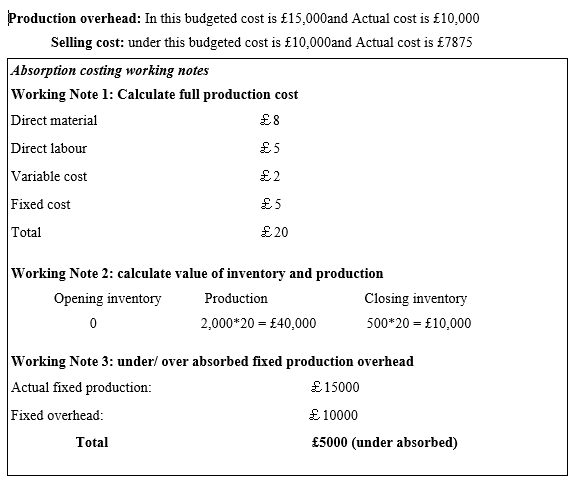

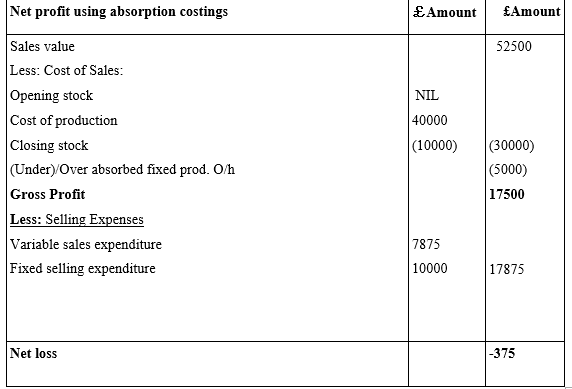

Absorption Costing: This is the costing method under which all the costs which are related to the production of the goods, considered (Becker, Ulrich and Staffel, 2011). This is the most effective tool which can be used by the Tech UK for optimising the net profits.

Marginal costing: This is the costing method which is used by the production manager under which consider all the variable costs whether that was related to the production or not. This is the most effective tool which could be optimised in an effective manner.

Cost volume profit: This is most effective tool which assist for calculating diverse kinds of modification in the costs and total volume that will affect operating incomes of a cited company.

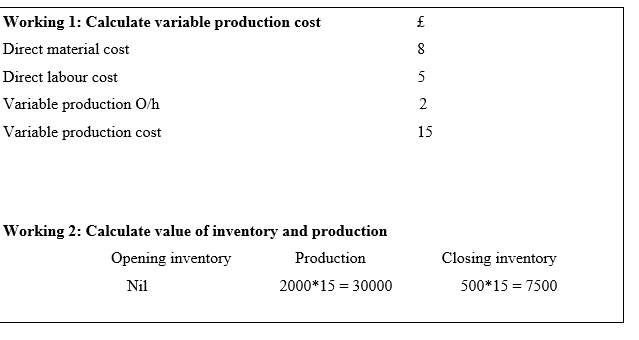

Income statement on the basis of Marginal costing method:

M2:

There are so many kinds of tools which assist in accounting process of a cited company. Product costs tools are highly justifiable in enhancing entire growth for the organisation. Standard costs are helpful for forming comparison of the cited organisation in related to the budget one. While marginal costing tools is highly effective for the management for enhancing entire development for the organisation.

D2:

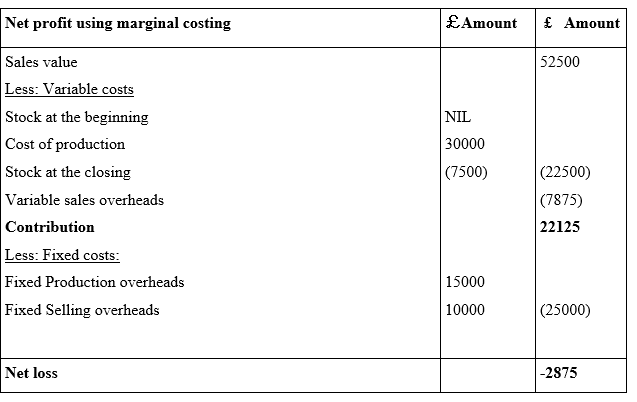

For assessing the result, this can be rightly said that the absorption and marginal costing methods are used to gain the sustainable development in an effective manner. Net loss as per the absorption costing is calculated -375 which is much less than the net loss calculated by using marginal costing (Hilton and Platt, 2013). Now, in both of the cases, net profits or loss is considered accordingly.

TASK 3

a). Budgets and their advantages and disadvantages:

There are so many budgets which are implementing these things:

Flexible Budget: This is the budget which can vary for the change in the volume of the activity. Flexible budget is highly sophisticated and this is more effective than the static budget that remains at one amount related to the volume of the activities.

Advantages:

- The main advantage of this budget is that it can be varied as per the requirement.

- This can be rightly said that the management of the cited organisation is specifically required to adopt this in an effective manner.

- Now, flexible budget of cited organisation helps to gain the sustainability in an effective manner.

Disadvantages:

This does not always reflect the genuine data which ultimately restrict the firm to grow at a more effective rate (Moser, 2012).

- This is the complex one as this requires changes according to the need.

Static Budget: This is the budget which is fixed and does not change as per the change in the circumstances. This is the most effective tool through which the static budget does not vary accordingly. This is a kind of budget which form forecasted values about input and outputs which are conceived before the time in question starts. At the time of comparing the actual outcome which are attained after the fact, numbers from static budgets are usually quite different from actual outcome.

Advantages:

- The main advantage of this budget is that this forecast the future expected value about inputs and outputs.

- This helps to get the sustainability by using this in an effective manner.

Disadvantages:

Once it was formed, it can’t be changed. This is rigid and can’t be changed.

b). Budget preparation process covering identifying of the pricing and diverse costing systems:

Here are so many steps which are needed to be adhered and control performance of the UK tech. some of them are:

At the initial stage, an adequate format of budget requires to be determined by the managers. According to an adequate idea budget needed are to be considered (Christ, 2014).

- On relying this, organisations total forecasting each revenues or expenses of diverse division which are send to the more level.

- In this step, reliable permission from more divisional process of the budget could be formed.

- After making a budget, this is rightly said that the board of director is form earlier permission.

- In the last step, this is eager to deliver in front of other parties.

Pricing method: There are so many pricing systems that would be elaborated as under:

Price skimming: As per this pricing tool this assist to help total sales of the brand advanced products of an organisation (Lavia López and Hiebl, 2014). During product development which would be more.

- Cost plus pricing: This is one of the most crucial tool that are implemented for fixing the cost of the product and services. Direct material costs, labour costs and overheads costs are to be considered while calculating cost plus pricing.

Diverse kinds of costing methods:

There are diverse kind of costing tools which are useful in assessing future purpose and objectives. Few of them are elaborated as under:

Direct costing: This occurs to highly efficient costing tools which covers diverse editing capacity of the outcomes. This comprises direct material, labour and diverse kind of overheads.

Standard costing: This has been observed that this is an essential aspect for handling cost and evaluating total variances for comparing actual results along with budgeted one.

C). Importance of budget:

Budget is the main tool via which forecasting of revenues and expenses are done for a particular period of time. Now, these budgetary tools are used in order to gain the sustainable development in an effective manner.

M3:

Planning is forecasting tool through which a firm could attain their objectives via adequate utilising resources of the cited organisation. There are so many tools like forecasting that are implemented by managers to assess forecasting of their costs. Balance scorecards is forecasting planning tools that are accountable for handling whole financial issues which effects on the entire performance of a company.

D3

It accordance to get more reliable and effective outcomes in near future time. The company need to make use of various financial tools that are reliable enough to deal with all kind of problems those are arises in an organisation. To overcome all of them a well organise systems is needed to be taken into consideration. In this process, they need to make use of balance scorecards approaches that would reliable in resolving various issues those are present in an organisation like TECH (UK).

TASK 4

Explain ways by which the Balanced Scorecard approach can be used to overcome the financial distress of an organisation:

Nowadays, it has been seen that plenty of organisation is facing some sort of financial problems that are affecting the profitability and growth at the same period of time. As per the mentioned case scenario that deal with TECH (UK) limited which is having a net loss of £ 1.5 million during the period (Wickramasinghe and Alawattage, 2012). As it is operating in electronic mobile charges and other gadgets. By this kind of issues, a large number of financial issues is arising in an organisation in respect to capital. In this stages, management accounting tools are considering more effective to deal with all these kind of issues. It also suggested that company has appointed an accounting to look after all those problems more closely. After analysing all the statements, offices have recommended to use some effective financial tools which is mentioned underneath:

Balance scorecards: It is known as the strategic planning and system that an organisation can uses to communicate what actually they are trying to attain in near future. It is most considering by the management in order to deal with all financial issues those are arises in an organisation.

There are various crucial tools that are needed to be taken into consideration while dealing with all financial problems which are arise in an organisation. Some of them are:

Ratio analysis: It is one of the most important tool which will be needed to deal with all kind of issues that are affecting the growth and profitability position of the company. profitability and liquidity position of Tech UK can only be determining by analyse their ability to make payment of liabilities.

It consists of certain kind of perspectives those are discussed below:

- Financial perspectives: This will be used by managers in order to analyse TECH (UK) present financial position and different users that are using resources of the company.

- Customers and shareholder: It seems to be crucial aspects that are related with all stakeholders regarding performance of an organisation to create wealth for their customers.

- Internal business process: It is associated with gathering data from internal departments on regular basis of appropriate quality of products.

- Organisational volume: Taking certain review on regular basis can help an organisation regarding capital, infrastructure and investments those are made by the Tech (UK).

Just-in-time: It is known as one of the reliable inventory management planning tool which align with raw material orders from that supplier those are related with the production process. The problem of inventory that are arises in the company can be resolve by using JIT methods.

|

TECH UK |

Unicorn grocery |

|

All those financial issues that are arise in the department can be resolve by using balance scorecard methods. |

Every organisation is having some kind of issues that are affecting the profitability position of the company. it can be resolve by using Just in time method. |

M4

It seems to be determine that there are various types of financial issues those are present in Tech (UK) limited. This will be lead to make large implication on productivity of an organisation. These can be reducing by using appropriate techniques such as key performance indicators and financial governances.

Set in Motion the Plan for Exemplary Grades with Our Extensive Academic Writing Services

Premium Assignment Services

CONCLUSION

From the above mentioned project report, this can be considered management accounting systems are the most effective tools which sustained the business in an effective manner. In this report, costing tools such as marginal and absorption costing are used. Various budgets are mentioned along with their advantages and disadvantages in an effective manner. financial problems are addressed by using BSC approach.

You may also like to read: