Introduction

1.1 Overview & Background

Banking sector is the most important aspect behind growth and development of a nation. It supports in effective management of financial activities and ensure proper circulation of money for industrial development. Banks face different kind of risk such as market, credit and operational which are effectively managed and understood but the issues exist with operational risk (Sun and Chang, 2011). Earlier, operational risk was commonly defined as every type of unquantifiable risk which are being faced by a bank.

However, operational risk is referred as the risk of monetary losses due to inadequate or failed internal processes, systems and people. Furthermore, external events also create operational risk for organization and affect performance of the same to a great extent. Moreover, external events such as a natural disaster which tends to affect physical assets or electrical or telecommunications failures.

It spoils overall business of corporation because recovery takes relatively longer time (Fethi and Pasiouras, 2010). Similarly, operational risk is also faced in term of employee fraud and product flaws through which rate of return of firm may be decreased.

The role of operational risk is very important in an organization and better mitigation of the same will bring the appropriate outcome. In this manner, a company suffering from issues of lack of profitability and low sales turnover can easily manage all business activities. It assists business entities to focus upon specific issues which are creating issues in successful operation of business.

Set in Motion the Plan for Exemplary Grades with Our Extensive Academic Writing Services

Premium Assignment Services

However, credit risk and marketing risk are estimated for future time span because they are closely related to financial performance of banks (Pagach and Warr, 2010). In the same manner, operational risk of banks is also estimated in order to resolve some of the major issues creating barriers in creating competitive edge of the business. Many a times, banks get issues related to fraudulent activities because incompetent workforce and failed software or technologies (Gillet, Hübner and Plunus, 2010). This are considered as the specific operational issues affect business of banks to a great extent.

The issues of poor management of internal activities or processes tend to increase operation risk as it increases chance of fraud etc. This is also the reason of unexpected loss because greater the operation risk, the greater the losses which was not expected.

Furthermore, effect of not complying regulations, appropriate law as well as implicit rules is also the reason behind higher operational risk. However, this is not the only way to reduced the same because management should continuous supervise all working affairs. In such manner corporation can integrate all business activities and risk associated with operational activities will be reduced to a great extent (Olweny and Shipho, 2011).

Present report is based on HSBC, British-based multinational banking and financial services company. This is considered as world's fourth largest bank in term of total assets. It has operation across 71 countries with 6000 offices. The business groups of banks consist of retail banking and wealth management, commercial banking as well as global private banking. In addition to this, investment banking is also included for the purpose of meeting organizational objectives by increasing customer base.

It facilitates to provide variety of services to end users and meet their expectations in an effectual manner. Moreover, HSBC is listed on Hong Kong Stock Exchange and London Stock Exchange. Operation of banks in number of countries creates issues in successful management of business activities. Owing to this, issues like fraud, poor management and other related negative aspect might occur at workplace. For this purpose, effective operational risk management practices are implemented by the management to assess risk along with corrective action (Sun and Chang, 2011).

The organization like HSBC manages the risk by assigning qualified personnel and IT expert along with keen attention of internal systems (Hasan and Dridi, 2010). This aspect play important role in managing business of bank in all of its branches as it is expanded in many countries. In such manner, management focuses upon highlighting appropriate alternative for effective internal management of business transaction.

However, organization follow regulatory standard for its ethical conduct of business through which business meet expectations of all its stakeholders (Fiordelisi and Molyneux, 2010). In the same manner, training and learning program are conducted for employees so they can learn regarding regulations and procedures applied in internal management of business.

1.2 Rationale of Study

In the current era banking sector has issue of compliance of regulatory framework. It is because business entities must work in the boundary of regulatory framework so that accordingly ethical standard can be ensured. Owing to this, the main objective for conducting the study is to determine the impact of operational risk management on performance of bank, named HSBC. This particular study shed light on issues which are being faced by corporation its operation and its potential impact on overall performance.

For this purpose, researcher conducts in-depth study for assessing the importance of operational risk management in reducing the risk for bank and ensures their successful operation. It focuses upon detail discussion of effective management of risk related to operation activities which are used by banks. Also, it will be effective in assessing the importance of different strategies and tools applied by management of bank for resolving such kind of issues.

The study on assessing the impact on operational risk management in banking sector also provides suggestions to improve the performance. At this juncture, different objectives are taken into consideration such as concept of operational risk management along with discussion on different types of risk associated with selected corporation. However, banks are to work in the regulatory boundary for ensuring their ethical conduct.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

It proves to be effective to meet expectations of stakeholders and standard which are set for long run growth. Owing to this, regulations associated with managing operational risk in HSBC bank of UK are also explained which in turn business can satisfy buyers.

The main purpose behind carrying out the study is to identify the importance of operational risk management for banks. It will also be studied that how these strategies are applied by business for reducing overall risk. If such kinds of strategies are effectively implemented at workplace then banks like HSBC can easily detect the risk. It is also effective for increasing sales turnover and increasing customer base for banking sector operating in UK. Overall study focuses upon assessing impact different operational risk management on performance of bank.

1.3 Research Aim and Objectives

Aim and objectives of any study are very important which provide information related to purpose of the study in clear manner. Research aim for study on operational risk management is mentioned as follows-

Aim

To determine the impact of operational risk management on performance of banks: A case study of HSBC, UK

Objectives

The objectives of current study are explained as follows. With the help of research objectives, appropriate outcome is drawn that proves to be effective for meeting research purpose. The objectives of study are framed in accordance with aim so it ease to accomplish the same.

- To understand the concept of operational risk management in banking sector.

- To assess different types of operational risk associated with HSBC bank of UK

- To identify the regulations associated with managing operational risk in HSBC bank of UK

- To recommend different ways for reducing operational risk in HSBC bank of UK

Research question

Research questions are formed on the basis of research objectives through which it becomes convenient for researcher to collect large amount of information. The research questions for current study on impact of operational risk management in banking sector are listed as follows-

- What is the concept of operational risk management in banking sector?

- What are different types of operational risk associated with HSBC bank of UK?

- What are regulations associated with managing operational risk in HSBC bank of UK?

- What suggestions with regard to different ways for reducing operational risk in HSBC bank of UK?

1.4 Significance of Study

The current study is very essential for determining the impact of operational risk management on performance of banks. With completion of the current report, HSBC will come to know different measures that can be applied for detecting risk on right time. It facilitates to ensure free flow of transaction and expectations of clients can also be met effectively. With the assessment of regulation affecting business corporation, it becomes effective to comply with the same by bringing modification in internal work environment.

Furthermore, with the collection of secondary information in the study, researcher also highlights overall risk associated with business which tends to affect overall corporation activities. The study will also come out with meaningful outcome which can be applied in banking to reduce operational risk

We believe in serving our customers with the most reliable assignment help

Furthermore, focus will be laid on impact on operational risk on business operation so that accordingly barriers associated with the same can be identified. In this manner, current study will be effective for HSBC bank to resolve operational issues by focusing upon problems. However, present study will help number of parties because researcher work will provide them assistance in different manner. It has been explained as follows-

- People who belong to the field of academics and preparing themselves for Ph. D and other degrees will get greater help from the present study on impact of operational risk. Furthermore, study will be effective in gaining deep understanding with regard to concept of operational risk management and its impact on business performance.

- Study will impart overview to the analyst in terms of assessing various measures of operational risk management as used by HSBC

- The current dissertation will also assist people associated with the field of literature in providing right direction with the evidence of good amount of information.

- Therefore, current study is significant for entire sector of banking operating in UK and along with different parties associated in the same field. This proves to be effective to become great source of their information.

1.5 Limitation of Research

A study requires enough time to complete all the procedure associated with it. Owing to this, main constraint which is faced is related to lack of time. At the same time, issues were faced while collecting seconday information because access of all sites was not given. Owing to this, researcher has taken prior permission to access some of the sites for gathering valuable information. However, time constraint has been resolved by completing the entire chapter in stipulated time span. Here, structured procedure of Gantt chart was followed in order to manage the time effectively. Apart from this, limitations exist in term of collecting some of factual information of bank. However, appropriate sources are accessed to collect enough information.

1.6 Structure of Dissertation

The structure of dissertation provides overview regarding all chapters to be completed in the study. It helps researcher to disseminate detail information which will be provided through each chapter. Explanation of each chapter covered in the study are given as follows-

- Chapter 1 introduction: This is the first chapter of dissertation which play important role in providing basic information related to topic. It is helpful to impart detail with regard to purpose of study and its scope. The chapter of introduction consists of background, research aim and objectives as well as significance of study. Along with that, research questions and structure of dissertation are also included which contain general information related to operation risk management for effective management of business.

- Chapter 2 Literature review: This is the second chapter of study consists of large amount of information related to topic. This chapter is completed by taking into account several sources of secondary information which proves to be effective in producing valid outcome. Furthermore, researcher access journals, books and online articles and accordingly information related to concept and appropriate approaches of risk management tools are explained.

- Chapter 3 Research methodologies: This is the third chapter of dissertation which incorporation information related to tools and techniques which are applied in the study. It includes explanation of research design, approach and type of research through which valid outcome of study can be produced. In addition to this, all selected research methods are explained in the respective chapter along with proper justification.

- Chapter 4 Data description: After completion of third chapter, next chapter of data description has begun. Under this, researcher provides overview related to collected data. It can be in the form of tables and diagrams providing clear description of collected data. It facilitates to reach at the outcome of the study as description is given in the direction of research aim and objectives.

- Chapter 5 Data analysis: After giving description of all data, researcher then analyzes the collected information in proper structure. Here, discussion of collected data is done by focusing upon aim and objectives. WHAT METHOD IS USED FOR ANALYSING THE DATA?

- Chapter 6 Conclusion and recommendations: This is the last chapter of study under which conclusion is drawn in accordance with collected information. However, recommendations are also provided on the basis of collected information. It proves to be effective to reach at the aim of the study and meet research objectives in an effectual manner.

Literature Review

2.1 Introduction

Literature review is the important chapter of the dissertation under in which essential information are incorporated. This supports the study to a great extent by providing evidence on the basis of collected information. Under this, research access number of sources of information such as journals, books and online articles which aids to produce valid outcome. In the current study on “impact of operational risk management on performance of banks” literature review has been done by preparing themes in accordance with the research objectives. For this purpose, all concepts of operational risk management in banking sector evaluated. It is helpful for understanding the importance of operational risk management in an effective operation of banks. In addition to this, under second theme assessment has been done on different types of operational risk which are associated with HSBC bank of UK. The description of operation risk provides ideas related to potential strategies or practices which can be applied for reducing the same. Apart from this, regulations associated with management of operational risk in HSBC bank of UK are identified in the third theme. In such a manner, different studies carried out by other scholars have been accessed by the researcher for addressing research problem.

2.2 Concept of operational risk management in banking sector

According to Ames, Schuermann and Scott (2015) operational risk is a loss to bank due to number of reason. It consists of failed internal processes, inadequate people and external events as well as the poor management. These stated elements are important for corporation and it must be focused the management to ensure long run growth and success of the business. For this purpose, operational management practices are implemented at the workplace to stop breakdown of four causes such as processes, system and external factors as well as people.

The risk related to operation activities in bank is identified at first and then exposures to those risks are measured effectively to ensure that capital planning and monitoring program are in the place. Furthermore, risk management process involves variety of measures for the purpose of risk monitoring along with need of capital is assessed on the ongoing basis. Apart from this, dissemination of information related to risk mitigation to senior manager which will be effective for reducing risk to a great extent.

Badescu and et.al., (2015) stated that, sound internal governance is the imperative aspect through which effective operational risk management framework is established. Here, it is ensured that how effectively internal operation is going on in accordance with ethical standard. This facilitates in meeting the requirement of all associated stakeholders and achieving their satisfaction level to a great extent.

Berger, Bouwman and et. al., (2016) argued that internal control is the most effective aspect under which day to day business is managed effectively for the purpose of ensuring effective as well as efficient management of all bank activities. At this juncture, emphasis is laid on reliable information, applicable laws, regulation which plays an important role in satisfying the clients. However, chances of fraud will be reduced to a great extent if focus will be laid on all mentioned aspect of bank.

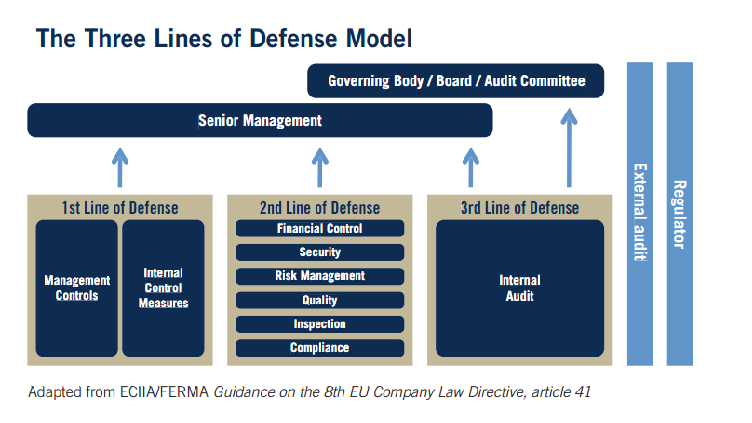

2.3 Sound operational risk management using three line defence model

According to Berger, Imbierowicz and Rauch (2016) sound operational risk governance is followed at different level such as business line management, an independent review and an independent corporation operational risk management function (CORF). However, the common industry practices might vary in accordance with size, nature and complexity associated with bank. Every bank has different risk profile and accordingly degree of formality of implementation of three lines of deference is implemented.

It can be critically evaluated that risk management practices of bank are fully integrated with operational risk governance function which in turn fraud and other related unfair activities can be detected in relativity less time span. Here, the first line defence is of business line management who is responsible for identifying effective management of risk inherent in the activities, processes and products as well as system. In case of compliance of regulatory framework and policies of Bank, line management can establish sound operational risk governance.

(Source:The three lines of defense in effective risk management and control, 2013)

Bromiley and et.al., (2015) explained that second line of defence is of CORF which performs the function of complementing the operational risk management activities of the business line. Here, degree of dependence makes a huge difference as scale of bank determines the same. For instance, large banks will work in accordance with risk generating business lines and covers activities related to design, maintenance and continuous development of operational risk framework in an organization.

For this purpose, CORF covers different functions such as measurement of operational risk, responsibility for board reporting and risk. It will be effective for banks to understand the risk associated with operational activities and resolve the same by applying effective aspects. Apart from this, second line of defence focuses on risk control and compliance under which degree of dependence remain limited to certain extent. Furthermore, management of banks perform several functions for related to risk management through which effective monitoring will be done for first line of defence control.

At this juncture, risk owners get effective assistance in order to pass on all important details related to operational risk. On the other hand, a compliance function consists of monitoring of risk associated with noncompliance of applicable laws and regulations. For better communication and reduction in risk factor, the separate function reports directly to senior management, directly to the governing body and some of the business sectors. Multiple compliance functions work better in the large corporation which shed light on compliance of specific aspects such as supply chain, quality monitoring, environment as well as health and safety of bank. It reflects that second line of defence play significant role in effective implementation at first line. Bushman and Williams (2015) argued that, functions of second defence consists of supporting management policies and defining roles as well as responsibilities which will be effective for better coordination of corporation. Apart from this, providing risk management framework is also the major function of under which small risk are detected at very beginning. Moreover, some known and emerging issues are also identified through different functions of first line defence.

Third line defence is of independent review and challenges related to control, processes and system which aid to manage the operational risk in an effective manner. It can be critically evaluated that in case of involvement of less competent workforce, banks cannot effectively implement such types of practices at workplace. Owing to this, it becomes crucial to involve trained and competent workforce who actively helps to reduce risk and ensure successful operation of the business. It would be better to include suitable qualified external parties because they are experienced enough and predict risk associated with corporation by assessing financial statement or other related information. Therefore, third level is all about internal control under which audit also proves to be effective. For this purpose, day to day operation is managed under the supervision of skilled and qualified workforce who will provide information related to any kind of difficulties to management.

According to Epure and Lafuente (2015) strong risk culture is required in an organization which facilitates to inter-connect all departments. At the same time, good communication among three defences is also an important aspect through which better coordination can take place. However, at the time of assigning role in assessing risk management process, it would be better to keep risk owners or managers in first line of defence. It facilitates to coordinate between other departments in accordance with the set of regulations. Here, operating management is responsible for all issues which takes place at the first line so that responsible person can work upon the set parameters for resolving the issues.

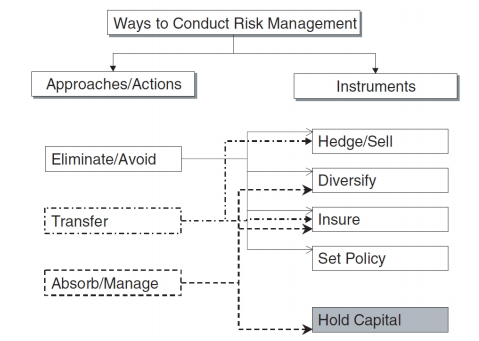

2.4 Tools and techniques for mitigating risk

Risk mitigation is the most important concept for successful operation of bank. It is because changes in external environment affect entire operation of business to a great extent under which financial corporations are required to change their strategies time to time. Chorafas (2003) asserted that two major ways of risk management consist of actions, instruments. Here, actions or approaches include transfer, management and avoidance or elimination. On the other hand, instruments such as set policy, insure, diversity and hedging are included.

(Source: Risk Management in Banking, 2016)

Here, elimination is the most effective aspect in certain circumstances wherein management of bank try to avoid risk by adopting appropriate strategy. For this purpose, HSBC can decide to eliminate certain risks which might affect its financial position in coming time period. At this juncture, such kind of risks are eliminated by using strategies like portfolios diversification. This portfolio diversification reflects that bank will invest in different segment through which in case of occurrence of loss in one department, it will get benefit from the other one. This ultimately reduces operation risk related to higher loss and poor performance of corporation.

Colquitt (2007) asserted that, buying insurance in the form of options or actuarial insurance also help to eliminate risk to a creating extent. Use of such kind of strategies provide relief to firm in case of any kind of contingency. In such manner, HSBC can also use alternative strategies such as process control, due diligence procedures as well as certain business policies. On the other hand, for example, HSBC does not want to avoid risk then management choose the transfer the same to other participants of market. It can be critically evaluated that for transferring risk bank need to assess about its competitive edge in the marketplace. Apart from this, some of the risks are very complex for the business which can not be transferred and managed by bank. However such kind of risk are not hedged by management of corporation and they are absorbed under the boundary of set rules and regulations.

Daniels and Ramirez (2008) explained number of techniques for effective management of risk. Here, diversification is considered as the most important technique for risk mitigation under which company can easily reduce the chances of failure. This technique plays important role in reducing frequency of best and worst outcomes. This will be effective to ensure smooth flow of business at international level.

Davydenko and Matoussi (2010) argued that hedging is also the effective method under which HSBC established position into one market to offset exposure to price fluctuations in some opposite position in another market. Here the basic purpose of corporation is to minimize the unwanted risk to a great extent (Internal control, 2016). Banks like HSBC can used number of hedging strategies such as insurance policies, swaps and forward contracts. Along with that, options, derivatives and over-the-counter as well as future contracts are also used in order reduce different kind of risk associated with bank.

According to Dima (2009)Internal insurance can be considered as the effective tool through which some pool of risk are hold by bank at internal level rather to buy external insurance. At the same time, sufficient amount of capital is put on hold for the purpose of reducing risk to a great extent. However, efforts are put to absorb the risk at internal level only under company can easily ensure its continuous operation in the marketplace. Moreover, operation risk of business affects overall performance to a great extent, hence its management is the important task (Risk Management in Banking, 2016).

Apart from this, six key principles are implemented in HSBC for risk mitigation purpose, Here, the first principle is of board awareness which shows that staff workers are responsible to provide information related to any kind of fault taking place at workplace. Furthermore, internal audit is conducted with inclusion of skilled workforce for detecting risk at very beginning (Managing trade risk, 2016).

Third principle is of senior management implementation and responsibility whereas fourth one is of identification of risk. However, fifth and sixth principles are monitoring and mitigation and control respectively. In such manner operation risk is managed through internal control and monitoring. This is also helpful to avoid some risk and absorb some of them for improving performance of business.

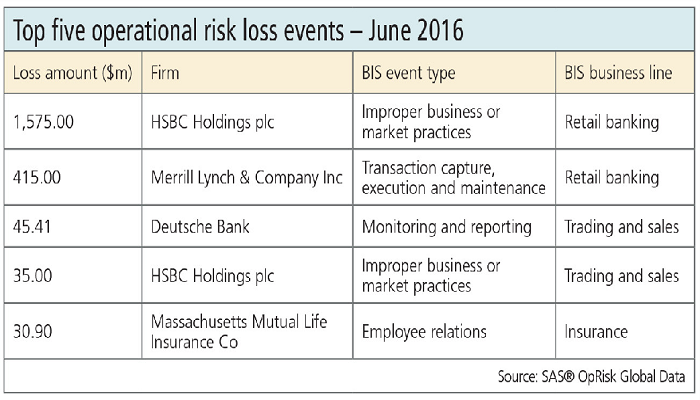

2.5 Key theoretical issues

The key operation issues which are being faced by HSBC bank are mentioned in the following table. This table represent five operation risk loss events till June 2016 of different corporation. It shows that, HSBC holdings plc face issues related to improper business wherein marketing practices are not working properly. For this purpose, 1575 million dollar loss occurred in retail banking. However, loss of 35 dollar million was also occurred because of improper business ($1.5bn subprime hit at HSBC dwarfs other op risk losses, 2016). This was occurred in the sector of trading and sales. It shows that company does not ensure inclusion of better practices at workplace and in result loss is increasing in different aspect.

(Source: $1.5bn subprime hit at HSBC dwarfs other op risk losses, 2016)

HSBC is also suffering from issues related to know-your-customers norms. This is because corporation is not focusing upon filling the forms related to the same and clients are provided chance to open their account. It proves to be unethical practices which affect its operation performance to a great extent. Owing to this, penalty has been imposed by Reserve bank of India because of unethical conduct of business.

At the same time, issue related to violation of anti-money laundering guidelines was also faced which in turn poor performance of bank can be assessed. Not only this, but tax aviation is also the critical issues under which HSBC was providing guidance to clients for saving their money (Money & Banking, 2016). It is considered as unethical practice wherein government fail to collect tax from bank because of false representation of financial statement. This proves to be negative for stakeholders associated with corporation along with bad image of firm in the marketplace.

Apart from this, issues of under staffing is also reason behind poor performance of bank. This is because organization is having issue related to anti-money laundering and know your customers. However, this procedures were implemented for the purpose of risk mitigation and smooth operation of business. It can be critically evaluated that businesses are facing issue in managing the these new rules in different countries and according operational risk are increased to a some extent (The new uk regulatory framework, 2016).

However, management of HSBC implement operational risk framework on the basis of four components. It consists of risk identification and assessment, actions/control. Along with that, KRIs and loss data collection so that risk can be reduced to a great extent and business activities can be integrated effectively. Furthermore, workforce are also provided training and need of the same is catered in advance through which business can easily increase overall rate of return.

It can be critically evaluated that, employee turnover is the crucial issue behind high cost of operation in company (Chance and Brooks,2015). This might be one of the reason for increasing loss and operation risk. Owing to this, management of company put efforts to increase workforce motivation and offer the monetary reward. Furthermore, organization can integrate all its operational activities and risk framework through which overall satisfaction among client can be ensured. This is not only about satisfaction of clients but effective management of operational activities. This proves to be effective for meeting expectations of buyers.

2.6 assessing different types of operational risk associated with HSBC bank of UK

Operational risks in the banking sector creates a significant impact on the operational measures and working criteria of the business unit. It creates a well defined impact on operational measures within the economy which enhances the efficiency of the working unit. According to Francis, Gupta and Hasan (2015) operational risks for the businesses are controllable factors which demands an effective regulatory compliance and well defined monitoring measure in an organization. Gao and et. al., (2015) evaluated that not long before has operational risk developed a formal position in the risk management aspect of the baking and financial sector. Researches revealed that banking is the sector which is entailed high risk aspects for the organizations working within the sector.

(Source:The seven operation risk event type projected by Basel 2. 2016)

The operational risks of the business create insignificant impact on the operational efficiency and working measures of the companies. This helps the organization in creating a well defined and significant impact on business operations. Gatzert and Schmit (2016) analyzed that financial services create an insignificant impact on the operational measures as it deals with complex tools and resources.

It has created a significant impact on business growth within the market as well. Giannakis and Papadopoulos (2016) analyzed different types of operational risks for the business which has fluctuating impact on success aspects of the business unit. Internal fraud is one of the significant factor which affects the business operations and create an indefinite impact on operational measures of the company within the competitive market. Golub (2015) stated internal fraud as one of the significant and most challenging aspects of operational efficiency. Fraud, misrepresentation or non compliance by the employees or internal committees of the business faces insignificant results for the operational aspects. Grote (2015) mentioned that actions related to internal fraud, forgery, non compliance of regulatory policies, misappropriation of assets, thefts, bribes etc are some common aspects of non compliance for the banking units (Haimes, 2015).

This enhances operational risks for the company due to a clear act of legal actions. BSE Bank of Singapore is one of the most recent example whose operations were restricted due to money laundering activities by the senior management of the business. This resulted the bank in losing its merchant banking operations in the region (Hall, Mikes and Millo, 2015).

External fraud is yet significant aspect of managing operational business risk within an organization. The challenges faced by the external market creates an indefinite impact on business inefficiencies and operational aspect. Hardy and Maguire (2016) analyzed that external risks have an uncontrollable impact on the business operations and inefficiencies within the economy. Ho and et.al., (2015) stated that banking operations could effectively suffer due to frauds and misrepresentations committed by third party within the business aspect. This creates an ineffective impact on the trust and security factors of the business.

The issues related to theft, fraud by agents or consumers, financial misrepresentation, forgery, data cheating, cyber crime are some common aspects towards the area. Banking operations as per Lippe, Katz and Jackson (2015) demands some crucial and sensitive information. The external party fraud committed for the business operations creates an insignificant impact on overall business growth and development. Li and et.al., (2015) analyzed that Theft, cheque fraud, and breaching the system security like hacking or acquiring unauthorized information are the frequently encountered practices under external fraud (McNeil, Frey and Embrechts, 2015).

Another aspects analyzed in the field is employee practices and workplace safety for the business unit. According to Mizgier and et.al., (2015) employees are the assets of the business unit who demands effective and well defined operational measures to create a significant aspect on business growth and development. Employees helps in attaining the business objective and enhance the sales aspects for the company.

Non compliance to employee policies and regulatory needs creates in effective results for the business unit. Nikolaou, Evangelinos and Leal Filho (2015) stated that high employee turnover or managing incompetent employee in the banking sector are the key challenges which affects the operational efficiency of the organization. An effective vigilance practice and managing effective monitoring practice within the market help banks in generating high and effective business results. Employee and workplace safety issues pose challenge for the banks as organization brand and reputation is at the stake for the company in this highly competitive economy.

Failing to meet the promises or deliver the promised quality aspects to the clients also affect the business efficiency for the banking operations. Consumers are the key focus of the banks. Negligence in practices by the banks regarding to security issues, quality aspects, liquidity measures, credibility etc affect operational measures for the business. Reason (2016) mentioned that Privacy and fiduciary breaches, misuse of confidential information, suitability issues, market manipulation, money laundering, unlicensed activities are the common aspects which can affect product defects or breach consumer trust in the banks (Haimes, 2015).

The external or systematic business risks for the organizations are ineffective and beyond control (Golub, 2015). The impact of any natural calamities on the operational efficiency of the business is one of the common and critical factor which effects the business operations. In addition to Sadgrove (2016) stated that operations related to Supply-chain disruptions and business continuity have always been a big challenge for banks. Fault in system hardware/ software affects the brand reputation. Which creates an insignificant growth aspects for the business unit.

The operational risk aspect demands effective delivery and process management operations for the business unit. Schönsleben (2016) mentioned that timely delivery and effective process of execution is an appealing feature for the business unit. Banks and financial institutions are demanded to manage and maintain well defined process management for the banks. Failure in processes for the company may affect efficiency of business outcomes. It may also create misrepresentation or mis-communication for the business operations.

Stulz (2015) stated that the impact of poor organizational management may affect the credibility reputation and finances of the bank. The above stated operational risk majors covers significant aspects or challenges faced by every business unit this effect the overall organizational function and growth measures in the economy.

2.7 Identifying regulations associated with managing operational risk in HSBC bank of UK

Su and Liu (2015) asserted that regulatory framework play important role in effective management of operation risk in bank. Here, government lays down several regulations through which business can ensure ethical conduct. The financial market regulations has updated its regulatory agenda during 2015. Under this structural reform and resolution in the financial sector is the main focus wherein restructuring is done for the purpose of meeting expectations of authorities effectively.

For this purpose, Prudential Regulation Authority of UK has been take steps for clarification of risk appetite in context of non-EEA banks. It effective effective for fulfilling resolution requirement of banks. Under this different barriers associated with sector are broken down so that accordingly banking activities can be managed in an effectual manner. By using this regulation, complex aspect of long term supervision plan will be developed. This contributes towards reducing operational kind of risk associated with organization.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

Furthermore, Banking Act 2009 specifies regulations with regard to management of crisis in banking sector. For this purpose, banks failing to deal with crisis can be put under temporary public ownership. In the same direction, The Turner Review highlights information related to banking crisis. At this juncture, coordinated international baking regulations has been established through which banks are rwuirwed to hold more assets. Here, regulations of liquidity is also taken into account whereby banks are given specific limit of cash. They are strictly order neither to increase the level of liquidity nor to decrease the same.

This aspect proves to be effective to meet its short as well as long term obligations. Ward and Peppard (2016) reported that credit limits are also set by government of nation so that accordingly customers will not face the issue of crisis. It also crucial for banks to provide training among workforce for their better development and effective implementations of all policies laid down by management.

The new regulatory framework shed light on new aspect formed for separate risk taking aspect of finance markets. This is considered as support to banking regulations because banks can handle their financial crisis effectively by making risk at very initial stage. It was came into effect since April 2013. During 2012 Financial Service Act, the financial service authorities lost their existence due to introduction of two new regulation.

Here the first one was Prudential Regulatory Authority (PRA) and the other one is Financial Conduct Authority (FCA) for better management of banks and detecting inappropriate risk taking place. At this juncture, The FCA, separate from the Bank of England, was working to ensure that financial marketing is working effective in the line of set standard and legislation (Banking regulation, 2016).

It is responsible for supervising competition among banks and appropriate management of all banking activities. It can be critically evaluated that, abusive activities of any of banks is supervised and legal action is taken against the same for the purpose of reducing chance of greater risk. Moreover, The FCA is also responsible for all the prudential regulation of financial services firms which are not examined by the PRA. At the same time, duty of assets managers is also assigned to FCA through which internal process as well as control system of banks can be work properly.

Apart from this, PRA is the part of Bank of England which work in accordance with set standard. It supports country to a great extent with introduction of stable financial system in UK. Wu, Olson and Dolgui (2015) argued that, stable system is created by forming number of rules and regulations through which operational risk of all banks is reduced to a great extent. However, the chances of occurrence of such kind of risk come to the end level due to strict rules and regulations. Owing to this, bank follow specific regulations and accordingly operational risk management practices are developed.

This proves to be effective in creating their brand image at international level and meet expectations of all associated parties. Apart from this, failure to management of operational risk cause legal decision against the responsible bank. At this juncture, bank ensures involvement of skilled and experienced workforce who can easily assess the risk. At the same time, internal audit system or policies are also communicated to banks so they work accordingly. This will be effective for corporation in reducing operational risk to a great extent and ensure expansion of the same at international risk.

The regulations of PRA is extensive wherein it has responsibility of around 1700 financial institutions, building societies and credit union. Along with that, banks, large investment firms, deposit takers as well as insurers are included in the responsibilities of PRA. This in turn effective management of all business activities will be ensured with increased rate of return. Therefore, regulations are also required to consider by management of corporation thereby different banking activities will be managed effectively.

2.8 Principle for the operation risk management (Basel committee on banking supervision)

According to guidelines of Basel 1 requirement of capital was set in advance in order to ensure minimal risk transfer. At this juncture, Basel accords are helpful for effective regulation of banks by focusing upon standard set for the same. It enables banks to reduce their operation risk by ensuring management of business in accordance with set standard. Under this, principle of operational risk management are specified by Basel.

The first principle shows that board of directors must ensure to have strong risk management culture. Accordingly workforce of the corporation will adopt professional and responsible behaviour. The board of directors and senior management are highly motivated due strong risk management and that proves to be effective for long run growth of banks. Apart from this, the board of directors take care of strong culture in entire organization through which all associated parties easily cater need of customers or clients. Owing to this, staff working in bank must be understood practices and policies imposed by upper level management. This aspect facilitates management to adopt ethical behavior so as to implement all related policies in an effectual manner.

According to Kenneth and Ramirez (2008) board of director can communicate regarding expectations and accountability among staff members which in turn prove to be effective for risk management. For this purpose, roles and responsibilities of workforce is mentioned clear through which they can complete the given task in an effectual manner. At the same time, senior management need to ensure available of training among workforce.

With the help of training personnel will learn new aspect for maintaining ethical aspect and in the same direction overall operation risk will be reduced to a great extent. The second principle reflects that banks like HSBC requires to develop and implement integrated framework with risk management processes. However, range of factors are considered while integrating framework with risk management processes.

These factors consists of complexity, risk profit and nature as well as size of business. For this purpose, framework should be documented clearly along with identification of structure which is used for the purpose of managing operational risk. At the same time, risk assessment tools are described effectively by focusing upon management information system (MIS). The role of MIS is very important under which management of bank like HSBC can effectively report for the risk to their immediate supervisor.

Third principle of Basel guidelines or regulation shows that framework must be established, review or approve with specific time span by board of directors. It will be effective for them to ensue compliance of policies and processes as well as system at all decision level. This principle is fulfilled by creating control environment with understanding the nature of operational risk in the strategies of bank.

It can be critically evaluated that effective independent review can be conducted for framework of bank through which operation of firm can be carried out effectively. In addition to this, fourth principle shows that tolerance statement and risk appetite for operation risk should be reviewed and approved by board of directors (Basel Committee on Banking supervision, 2011). However, at the time of revision and approval, management of bank take care of relevant risk such as level of risk aversion, strategic direction as well as current financial situation of bank. Apart from this, review will be done by the help considering changes in the external environment, the quality of the control environment and material increases in business or activity volumes. Along with that, mitigation strategies and frequency of loss are also considered for better management of operation risk at workplace of bank.

Furthermore, fifth principle stated that senior management of bank should develop consistent line of responsibility for approval by the board of directors. They also liable for maintaining and implementing policies, system and processes for appropriate management of risk. For this purpose, senior management of bank like HSBC should transform the framework of operational risk management in the specific procedures and policies which are implemented in different operational units. Here, it is also important to encourage workforce for reporting relationships and maintenance accountability.

Moreover, Chorafas (2003) asserted that role of disclose is also very important for operational risk management in bank names HSBC. At this juncture, formal disclosure policy of company should also be implemented in bank which will be approved from board of directors. Not only this, but process for assessment of appropriateness of disclosure policy is also done by taking into account verification and frequency.

Reseach Methodology

3.1 Introduction

This research chapter creates a clear and in depth picture of research measures and issues adapted by the companies to create a significant and well defined impact on research analysis and aims. It creates a well defined picture of the research tools and techniques adopted by the researcher to attain effective and well defined objectives. The present study focuses on determining the impact of operational risk management on performance of banks. Different type of tools and techniques are present which are employed in accomplishing aim and objective of the research. Research methodology cover various aspects such as data collection, sampling, The sated aspect of the study will be attained in a structured and effective manner. Only secondary research analysis will be carried out in the study as it will help the researcher in attaining valid and reliable results for the analysis. The case analysis of HSBC bank will develop clear picture of methodological aspects for the study.

3.2 Research philosophy

This is the basic and most crucial aspect of the study which focuses on developing an effective and well defined base for research study. The outcome of the stated issue develops a broad overview of data collection and analysis aspect. This factor of the research study helps in developing a clear picture of analyzing the research intent and analytic aspects (Fiegen, 2010). The current study focuses on analyzing the impact of operational risk management on performance of banks.

Positivism and interpretivism are the common philosophies adopted by the researchers in order to attain a well defined and effective business results. The former philosophy adopt rigid scientific approach for the study which helps in attaining valid and reliable results on the basis of scientific tools and analysis. The outcomes of these studies are commonly universal applicability of which is common. Interpretivism philosophy on the other hand demand involvement of social and behavioral aspects which are not constant for the studies (Grafton, Lillis and Mahama, 2011).

The present study will adopt interpretivism philosophy because the outcomes of the study will be attained by considering the employee and managerial response towards operational risk aspects. The researcher will collect interpret and attain the research result for the study. Positivism approach will not be applied in the present analysis as the outcomes of the study will be on the basis of employee response rather than scientific approach for the study.

3.3 Research approach

This aspect of the study deals with effective and well defined aspect of analyzing the data and attaining well defined result for the research issue. Inductive and deductive are the common approaches adopted in the research analysis method. Deductive approach is the one which use the method of data collection to attain effective and well defined results for the research issue. This approach is a useful tool to consider social and behavioral aspect for the research analysis (Guercini, 2014). Inductive research approach on the other hand is a quantitative scientific approach where the analysis is made on the basis of hypothesis testing.

This helps the in attaining accurate and scientific result for the study. It is an effective tool for quantitative research studies. The present study focuses on attaining an effective result regarding operational risk measures within the banking sector. The study has adopted deductive method as the results will be attained on the basis of research questions for which data collection will be done (Hill, 2007).

This will create an effective and well defined impact on analyzing the business issues and aspects related to operational risks for the banks. Inductive research approach will not be applied in the study as data availability on the stated topic will be challenging task. Moreover, hypothesis testing approach will not involve the managerial and employee perception regarding operational risk analysis aspect. This will help the study in developing an effective and well defined prospect for attaining a clear research picture.

3.4 Research design

It is regarded as the blueprint of the study and highlights the effective ways with the help of which aims and objectives of the research can be accomplished easily. This aspect of research analysis focuses on analyzing the research design that will be carried out by the researcher to attain effective and well defined results for the study. There are various research designs adopted by instigators for different research issues.

The most common research design includes exploratory research, descriptive research, case study analysis, scientific research, experimental research etc (Hogg, 2008). Every Design focuses on attaining different research approach for attaining the research issue. Descriptive research focuses on developing the results on the basis of general theories and prove the same within the overall analysis.

Exploratory research n the other hand focuses on evaluating the new concepts or seeking a new perspective of the study. Scientific researches deals with issues demanding mathematical or scientific approach to be solved. Hence, every research design approach the research aspects in its own way (Hussain, 2011). The present study aims to determine the impact of operational risk management on performance of banks. The descriptive analysis method will be applied in the study as the research issue is common yet demands an in depth analysis about the issues.

3.5 Research type

The research type may be characterized as qualitative and quantitative research which clearly helps the researcher in analyzing the research method and design of the study. This is a well defined measure to structure the overall analysis and attain effective and clear results for the issue. Qualitative type of researches are those which demands both hard and soft aspects of analysis (Kothari, 2011). The behavioral aspect individual perception and changing needs of the people are effectively taken into consideration.

Quantitative research on the other hand use the mathematical approaches and measures to deal with the research problem. It adopts well defined means of tools and techniques to attain accurate and clear results. The present study has adopted qualitative approach as it focuses on attaining the results in an effective manner (Lee, 2014). The qualitative aspects of the study will help in creating a clear and significant picture for the current analysis. This research aspects created an effective research approach and picture for the current issue within for the stated problem.

3.6 Data collection

This is another important part of researcher methodology which provides detail overview related to collected data, Basically two types of data are collected in the research such as primary and secondary. The former one is collected at first hand for the specific purpose of research. It takes relatively extensive time for completing the entire process of data collection from designing to analysis (Fiegen, 2010). On the other hand, secondary information is collected from already available sources.

Here, relatively less time is consumed because researcher has variety of option from where information is sorted in accordance with purpose of the study. There are number of sources for collection of primary data such as interview, questionnaire and observation. Interview method consumes more time because under this scholar ensure one to one interaction with respondents.

However, this is little inconvenient when time and cost constraint are available. In the present research only secondary information has been collected and primary data has not been obtained due to the nature of research (Grafton, Lillis and Mahama, 2011). Secondary data are collected from sources like journals, books and online articles. Moreover, other sources for secondary information like annual reports, CSR reports of banks and bank of England website are also accessed.

These all selected alternatives are great source of information for researcher so that investigation can be completed with available if fruitful information. Further, with the help of secondary information it is quite possible to focus on overall aims and objectives of the research. The information being published in the books along with online articles provides base to the research and in turn it provides base to the entire study (Hussain, 2011)

3.7 Data analysis

Data analysis is another most important part of research methodology which play active role in presenting the outcome. There are two types of techniques used for analysis of collected information such as qualitative and quantitative. The quantitative kind of techniques make use of correlation, regression and other related statistical test. This has basic aim of the assess the significant impact of one variable on one or more.

On the other hand, qualitative type of investigation uses thematic analysis wherein in-depth analysis is done for collected information (Kothari, 2011). Here, researcher make themes in accordance with the secondary data or research question which are then represent the help of diagram or frequency table. It facilitates to provide better presentation of collected data. It shows that, thematic analysis has been applied in the current study under which research presented all of collected information in very effective manner. This facilitates reader the understand the scenario effectively and interpret the collected results in most effective manner.

Apart from this, thematic analysis has been done with clear description of each covered themes in the light of aim and objectives of study. This proves to be effective to assess the impact of operation risk management practices which are being carried out in HSBC on its performance (Grafton, Lillis and Mahama, 2011). In such manner, valid suggestions has also been given to improve the performance of bank so as to ensure its successful operation. Therefore, in-depth analysis has been done with the help of application of thematic analysis for giving detail description of all collected secondary data.

You may also like to read:

References

- Fethi, M.D. and Pasiouras, F., (2010). Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey. European Journal of Operational Research

- Fiordelisi, F. and Molyneux, P., (2010). The determinants of shareholder value in European banking. Journal of Banking & Finance.

- Gillet, R., Hübner, G. and Plunus, S., (2010). Operational risk and reputation in the financial industry. Journal of Banking & Finance.

- Hasan, M.M. and Dridi, J., (2010). The effects of the global crisis on Islamic and conventional banks: A comparative study. IMF Working Papers.

- Olweny, T. and Shipho, T.M., (2011). Effects of banking sectoral factors on the profitability of commercial banks in Kenya. Economics and Finance Review.