Introduction To Hospitality Industry

Hospitality industry is customer oriented sector, according to companies have use optimum utilization of financial resources in order to fulfill needs and wants of customers (Dittenhofer, 2001). In the first part report will focus on various sources available to hospitality industry for their sustainable future whereas in second part report will discuss about monitoring and controlling of performance at Mark and Spencer Company. In third part repot will highlight the importance of budget and purpose of budget. In the fourth part report will focus on financial statements of R. Riggs Company in order to identify and evaluate their financial performance.

Sources of Finance for Small Business

Sources of finance are basic requirement for any organization, industry or sector in order to perform their task effectively and efficiently. There are various methods of raising funds or money in any industry and every company adopts different types of sources based on nature of business operations (Shim and Siegel, 2008). In other words finance according to corporate can be termed as managing of large funds or money by company for future sustainability. Sources of funds can be categorized into two sub heads: internal sources and external sources.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

Internal sources

In basic term these sources of finance are those which are raised within organization. In other words, internal sources of finance are those which are acquired from the previous profits or revenue generated by firm as the source of new capital investment. There are various internal sources through which any organization operating in any industry can raise their required funds or money such as: owner’s capital, retained earnings, sale of fixed assets and debt collection (Obura and Bukenya, 2008). The major focus on raising these funds is to meet short term liabilities of business operations.

Retained earnings – It is part of profit which is retained for facing future dilemmas in business operations. Retained earnings are the results of past performance by firm in hospitality industry.

Selling of fixed assets – In necessity Firm has to sell their fixed assets in order to generate funds for future functioning but doing so will make long terms assets lose which might be fruitful for them in future.

Owner's capital – Operating at a small scale level, this source become the essential for the future functioning of the firm. However, it is not possible to generate large funds through this source but sufficient amount so that they can start the business activities. Therefore, company as a single entity cannot rely on this source of finance.

Debt collection – It plays a significant role for the company generate funds. Collecting long term debts will assist firm to generate high amount as well as assist them to improve their debtor collection period.

External sources

External sources of funds are those which are raised from outside organization in order to fulfill long term liabilities of business operations. These sources of finance are used to perform long term business activities for future sustainability. There are several external sources of finance which can be acquired by company in order to increase their funds such as: issue of shares and debentures, bank loan, government grants, creditors and hire purchase.

Investors – Through this sources firm can obtain finance by gathering bunch of investors to endow in their business operations. As it will reduce monetary burden and risk from business enterprise.

Bank loan – Nowadays numerous banks provides funds in form of loan to various companies. As it is one of the easiest modes of generating or acquiring cash of liquidity. The interest rates offered by institutions are flexible which is feasible for hospitality industry firm.

Angel investors – Firm can indulge angel investors to acquire funds, as they can be a family member, friends or relative which does not have the intention to generate profits.

Hire purchase – Through source of finance firm can purchase the required essential resources on credit with the repayment period. Furthermore, through this firm can acquire latest technology or method of services to enhance their operations.

The above discussed sources of finance can be used by hospitality industry according to their needs and wants and accomplish business operations effectively and efficiently. According to case study company can use external sources of finance in order to generate income for purchasing machinery for improving overall performance and achieve desired goals and objectives. For purchasing machinery of £50k company can adopt bank loan, leasing it is recommended because of financial position that firm holds now. Being a private limited company it is the best suitable option for firm to generate income in short duration of time. Taking bank loan is feasible for them because they are enhancing their position in existing market, so to make repayment of loan it will not be a problem for the firm.

According to the case study generating sources of finance for expanding chains of restaurant, company should use external sources of finance because on the basis of present condition company is operating at low level and for them raising funds internally will be difficult (Hill, 2013). There are several sources of finance through which company can acquire funds for expanding large chain of restaurants such as bank loan or leasing. Both these sources would be most appropriate for company in order to acquire as well as repayment of funds. Firm should critically analyze these sources in order to evaluate pros and cons of adopting these sources of finance.

Bank Loan: for raising funds quickly bank loan can be adopted by any company, this source is effective as funds can be easily available through bank loan and repayment of loan is based on monthly installments. Company in order to expand or increase their chain of restaurants can use this source of finance so that future functioning can be done effectively and efficiently (Bragg, 2010). But disadvantage of this source that even is company is not making profit than also have to incur payment of interest.

Leasing: this source of finance can assist company is acquiring latest technology for upgrading the services provided in restaurant. As company wants to increase their chain of restaurants can use this source because they will require buildings at various places and equipments installation for increasing the efficiency of restaurants (Mongiello and Harris, 2006). But the main issue regarding this source of finance is that acquired assets would always belong to financial institution only.

Investors – Engaging investors will assist firm to generate high funds so that they can easily expand their chain of restaurant. Through this sources firm will generate money as well as they will help in making decisions regarding future functioning of the firm. Already operating in the market will assist the management to easily enhance their stakeholders so that overall functioning can be improved.

Sale of fixed assets – In order to acquire the new and latest machinery, restaurant management can sale their existing and outdated equipments and fund generated through that can be easily used in purchasing new machinery.

Angel Investors – This can be a feasible source for the firm as they are trying to open a new restaurant they can take help from their family members or friends which have no additional return expectation than the principle amount. They can assist in generating large amount because this type of investors can be defined as the rich people.

From the above discussed sources of finance company can generate income for expanding chain of restaurants. Apart from that company can use internal sources for further successful functioning. Bank loan and leasing are suggested because company wants to expand in chain of restaurants. As the present financial condition of firm is stated it is a small business enterprise.

Monitoring and Controlling Performance at Mark & Spencer

Cost in general terms refers to an amount which has to be paid in order to have something. According to business, cost is termed as monetary valuation of effort, material, resources, time and utilities consumed etc. there are various elements of cost such as material cost, labor cost and overheads. Firstly, material cost refers to the cost which is incurred by Mark and Spencer Company in order to produce finished goods. This cost is divided into two sub category direct material and indirect material (Brigham and Ehrhardt, 2011). Secondly, labor cost refers to the human efforts consumed in producing finished goods from raw material. Payment made for performing those activities is called labor cost. This cost is broadly classified into direct labor and indirect labor. Thirdly, overheads refer to the cost incurred by Mark and Spencer Company apart from material cost and labor cost for producing products and services. Overheads furthermore can be divided into sub category such as indirect and direct overhead. Direct overheads refers to those cost which are specifically incurred during manufacturing of products and services, whereas indirect cost refers to all the expenses incurred apart from indirect material and indirect labor (Li, 2003). Fixed cost and variable cost are explained theoretically.

Fixed costs – Fixed cost can be defined as the cost that Mark and Spencer has to incur in order to perform their activities. The main advantage of this cost is that even though the level of production increases cost remains the same.

Variable costs – This costs can be defined as the cost that may fluctuates according to the level of production. Variable cost for Mark and Spencer may be high as they constantly make efforts to enhance their productivity with quality and quantity.

Direct cost – Direct cost can be termed as the cost that have direct impact on the overall financial aspect of the firm. For Mark and Spencer direct cost may be manufacturing and distribution costs.

Indirect cost – Indirect cost can be defined as the cost that have indirect impact on the overall functioning of Mark and Spencer. Indirect cost for Mark and Spencer can be the packaging, advertising, maintenance, security and supervision of products and services of the firm.

Controlling Of Cash And Stock

Controlling Of Cash And Stock is major task for Mark and Spencer Company as they deal in retail sector. Every manager is making various efforts in order to improve company’s performance day by day like sales managers are focusing of generating enough sales to meet out desired goals and objectives, on the other personnel managers are focusing of controlling and managing human resources effectively and efficiently for desired results and thirdly, financial managers are focusing on managing all incurred costs like direct and indirect costs. Mark and Spencer are one of the giant retailers in global market (Brigham and Ehrhardt, 2011).

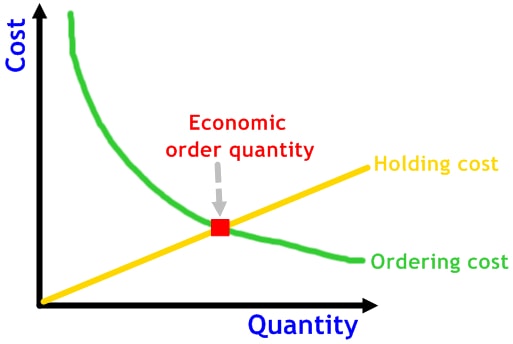

Economic order quantity

Company incurs several cost which can be easily identified and evaluate with sales volume. These incurred costs can be terms as direct cost such as carrier bags offered to the customer for their convenience and comfortability in handling products, and cost regarding the recruitment of qualified and different ethnic background for serving customers effectively and efficiently. On the other hand controlling of stock will assist Mark and Spencer to provide quality with quantity of products and services to its targeted customers (Power, 2010). By managing inventory company can also increase their sales volume or increase customer base which would be beneficial for future contingency of company’s operations.

FIFO – This method indicates the first come first out system which means, the product which enters firstly into the inventory is sold firstly. Through this method Mark and Spencer can manage their inventory in effective and efficient manner.

LIFO - This method focuses on the unit that enters last into the inventory is sold out firstly. Therefore, the older inventory is left over at the end of the accounting period.

Budgetary Control

Budget process refers to the process through which company prepares and approves budget for flowing of funds in business operations. By preparing budgets company can prioritize activities and on that basis spend funds and later on review whether operations are working properly or not. In other words, budget is prepared to compare actual performance of business from desired one. Budgets assist managers to indulge in various essential operations such as setting up goals, optimum utilization of financial resources in order to improve future financial performance of company (Graham and Harvey, 2001). Budget aims at providing financial information for making future strategies in achieving desired goals and objectives. In an organization several budgets can be prepared such as sales, cash, material, labor and master budget. All these budgets assist identifying and evaluating past performances of company and according to that make decisions regarding future contingency.

Financial Statements

Trial balance is a statement prepared at the end of financial year, including ending balance of each account. The main aim of this report is to ensure that total amount of all credits equals to total amount all debit, which indicates that there is no unbalanced journal entries in the accounting system (Coleman and Anderson, 2000). It is a type of financial statement which assists in providing information regarding financial performance and changes in financial position of an organization which is useful for decision makers. There are various limitations of a trial balance such as: an error relating to original entry, error of omission, error of reversal, error of commission, error of principle, compensating error and transposition error (Wildavsky, 2006). The main purpose of preparing a trial balance is to ensure that entries in company’s bookkeeping system are done mathematically.

Costing Methods

Cost in general terms refers to an amount which has to be paid in order to have something. According to business, cost is termed as monetary valuation of effort, material, resources, time and utilities consumed etc (Li, 2003). Cost can be sub-divided into three categories are as follows: fixed cost, variable cost and semi variable cost.

Fixed cost – fixed cost refers to the cost which does not change with an increase or decrease in the amount of goods or services produced. In other words, fixed costs are the expenses that have be paid by producing company. It is one of the components of total cost of goods or services, along with variable cost.

Variable cost – variable cost are those costs which changes as company changes its level of production. It is also sum of marginal cost. In other words, term variable cost is also known as unit level cost as it changes with numbers of unit produced (Dittenhofer, 2001).

Semi variable cost – semi variable cost refers to an expense which indulges both fixed cost and variable cost component. Fixed cost is an expense which company has to bear even if they are not generating profits. On the other hand, variable cost increases and decreases on the basis of increase and decrease in the level of production.

Conclusion

From the above report it can be concluded that costing play a major role in functioning of every business. In the first part report discussed about the sources that services industry should use for future functioning, and it has been recommended that externals sources should be taken in account for expanding business of restaurants. In late part report focused on R. Riggs Company’s financial position through analyzing P&L account and balance sheet and calculating several ratios.

Students also like :

Finance Hospitality Assignment Sample

The Contemporary Hospitality Industry

Role of Food and Beverages for Hospitality Industry

References

- Brigham, F. E. and Ehrhardt, C. M., 2011. Financial Management: Theory and Practice. 8th ed. Cengage Learning.

- Coleman, M. and Anderson, L., 2000. Managing Finance and Resources in Education. SAGE

- Dittenhofer, A. M., 2001. Behavioral aspects of government financial management. Managerial Auditing Journal.

- Graham, J.R. and Harvey, C.R. 2001. The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics.

- Li, S., 2003. Future trends and challenges of financial risk management in the digital economy", Managerial Finance. 29(5/6). pp.111 – 125.

- Michayluk, D. and Zurbruegg, R., 2005. Editorial introduction: the value and scope of the financing decision process. International Journal of Managerial Finance.