Introduction

Researchers of the Federal Reserve Bank have looked at the various movements of the stock market influenced by the price of oil and discovered that there is a relationship between these two variables. Their study has proved that oil price can impact directly on the stock market that because of changing of oil prices, the reactions of stock market also change simultaneously. It is also considered that for the oil prices the past decade was like a ride on roller coaster.

Variability and volatility are included in this decade also for which stock market is changed for which financial crisis can lead to great recession. According to (Phan et al. 2015, p.250), the changes of supply and demands of oil all over the World, price also changes effectively. Many of the economic sanctions would have been lifted by the negotiation of the deal between The United States and Iran in order to curb the nuclear program of the country. In this case it can be stated that if the political party Congress approves this deal between these two countries the oil of Iran can be easily available and the oil begins to fill the market and as a result the overall demand and supply of oil can get influenced along with the oil prices and it can directly affect on the stock market.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

Literature review

Since 1990s there are booms and busts in the oil industry with deepest effect for which the whole stock market get affected directly. According to (Allegret et al. 2015, p.235), since 2013 the overall oil supply of the whole world has been increasing. Daily production of oil is measured in barrels and in the second quarter of 2015 it was viewed that the average production of oil was around 96.39 million barrels each day.

Stock market - Stock market is that place where all publicly held shares of companies are traded and issued appropriately according to the rules and regulations of SEBI and government rules and legislations through the over the counter market or exchange traded. As cited by (Tsai, 2015, p.45), Stock market is also known as equity market and it is also considered that the stock market is one of the most important aspect of a economy in order to measure financial growth of a country's economy effectively and efficiently. It is also known as the economic barometer in order to evaluate the situation and condition of a n economy.

According to (Zhu et al. 2016, p.38), the stock market helps to value shares and securities on the basis on factors like demand and supply that can contribute economic growth and liquidity. Stock market of a country can also interpret the savings and investments pattern of a company in order to view the economic development and financial situation. In order to ensure liquidity and supply and demand of shares and securities, the stock market permits healthy speculation. Therefore in this case of impact of oil prices on stock market of Iran, evaluation of stock market and its importance should be understood properly and appropriately to analyse impact precisely and accurately (Basher and Sadorsky, 2016, p.235).

We believe in serving our customers with the most reliable assignment help

Oil prices - Larger fluctuations of oil prices can cause more stable investments on bonds, debentures and securities. The laws of demand and supply are considered as the main cause of fluctuations in oil prices. As cited by (Deshmukh et al. 206, p.77), Lower demand of oil can be caused for rise in oil price and the excess supply of oil can cause fall in price.

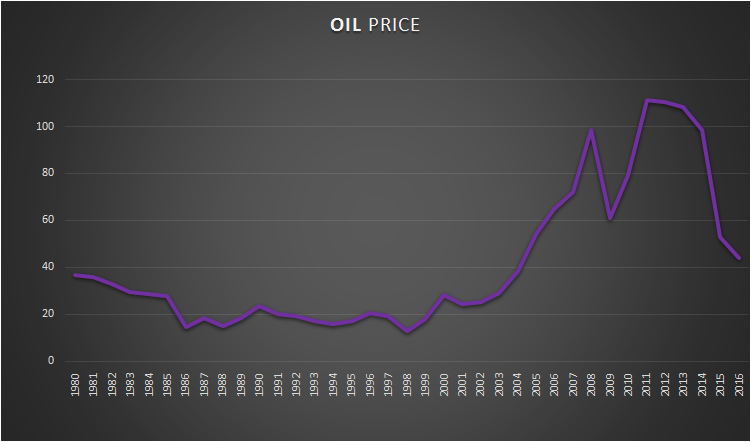

Impact of oil prices on stock market- OPEC or the Organisation of Petroleum Exporting Countries is considered as one of the main influencer of rise and fall in the oil prices effectively. This organisation can control around 40% of the supply of oil in the whole World. According to (), OPEC agreed to keep the oil price as $100 per barrel in future but in the year 2014 the oil price began to fall to below around $50 per barrel.

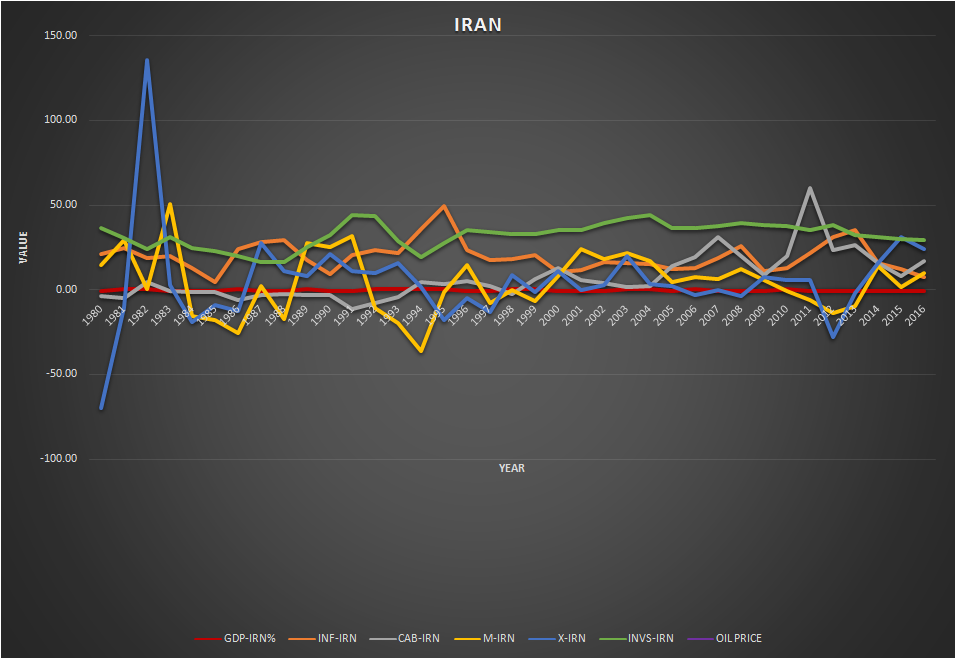

For this reason development and improvement is commented by the financial press after viewing the falling pattern of stock prices because of price of oil. According to (Huang et al. 2015, p.24), fall in the oil price is considered as the good sign for a country’s economy for US and China, the oil importers countries. There is a positive relationship between the oil prices and stock market. From the above graph the whole matter can be understood appropriately as it shows that oil price is continuously falling year to year.

From figure 2 it is also understood that the relationship between the stock market and oil prices is volatile in nature and positive correlation of oil price and stocks can rise as the both factors are responding to the shifts of global demand effectively.

Methodology

Research methodology part of a study includes the methods and techniques selected by the researcher in order to conduct research work. Based on the nature of the study the researchers should have to select different methods that will help the researcher to gain various data and information regarding the research topic (Le and Chang, 2015, p.262). In order to evaluate and interpret the topic appropriately and in a standardized manner, the researcher should have to justify all the tools and techniques.

Research approach - In order to develop and improve the overall format of the research study the researcher applies research approach with the help of deductive or inductive method. According to the availability of information and data, selection of research approach can be done by the researcher effectively and efficiently. Deductive approach is the process that discusses practical application of theories and models in order to gain knowledge regarding the research study.

On the other hand inductive approach is the method which can build new model and theory and the researcher can gain proper and accurate data and information based on the research study appropriately and effectively (Dehaghi and Mirhashemi, 2015, p.135). In this study the researcher applies the method of inductive approach in order to gain proper data and information and application of the data in the research.

Want to Join the Circles of

HIGH ACHIEERS?Make it a reality with our EXPERTS

Order NowResearch philosophy - Research philosophy is considered as an important aspect of the research methodology in order to analyse and interpret the research topic appropriately and effectively that can help the reader to understand the study. As cited by (Bondia et al. 2016, p.560), based on the research study and nature research philosophy is selected.

In order to analyse and interpret the research topic of this study in a standardised manner, the researcher applies the research philosophy of interpretivism that can ensure to describe the information and facts regarding the topic precisely minimising the conflicts and errors. The method of post positivism is not followed as the research study is not based on any model or theoretical data and information.

Research design - Research design can help the researcher to explain the research study properly and accurately with the help of three types of research design. As cited by (Bahmani-Oskooee and Saha, 2015, p.730), in order to identify the research issues properly this method can be used. Explanatory method of research design emphasises on the various questions and the exploratory process is applied at the time when the issue is not defined properly and appropriately. In this case study the researcher should have to select descriptive method in order to understand the topic in a standardized and appropriate manner.

Data collection and sampling - In this research study the researcher have to select quantitative data and use secondary data from government statistics, journals, books, articles to ensure all the data are provided in an accurate manner. The researcher uses sampling method in order to interpret data for a particular time period of 2012 to 2016 to meet research objectives based on charts and graphs.

Analysis and findings

In this chapter of the case research study the researcher will show the impact of oil prices on the stock market prices with the help of governmental statistical data and quantitative approach. According to (Sharma et al. 2016, p.245), data analysis helps in evaluating and describing the collection data and information in an effective manner.

Analysis of impact of oil price shock on the stock market of Iran should have to measured based upon the below mentioned factors.

WTI Price - Crude oil prices can measure the oil’s various barrels of spot prices of West Texas Intermediate (WTI) that is a very high quality of and lightweight and it is considered as one of the major crude oil benchmark. Higher price of WTI crude oil can affect directly the gasoline cost, electric power generation and manufacturing and for this higher price cost of regular things get affected and cost will increase. Iran in this case will have to cut the production of oil in order to raise the price level and make profit (Fallah and Ghaffari, 2015, p.125).

Brent Price - Brent crude oil is considered as one of the major important trading classification of the light crude oil. Brent oil is easy to transport to different countries globally. The crude oil in recent times is oversupplied and in such situation Iran nuclear deal will create more oil supply in the global market which can lead to create a wide gap between the demand and supply (Chakraborty, 2015, p.227). From the graphs it can be said that the price of oil is continued to decrease and for this reason the stock market is continued to fall. In the year 2016 the condition of stock market in Iran is lower as the oil price is decreased.

Inflation - Inflation is the rate at which there is a persistent rise in the prices of products and services for which the purchasing power of customers will decrease as well as there will be depreciation in currency. According to the investors of the Federal Reserve and business enterprises it is considered as one of the important aspects as if unanticipated inflation works through the level of economic situation the stock prices can also get affected. If there is high level of inflation rate in the market of Iran then it is good for economy as it will create employment but on the other way organisations in Iran will decrease the profitability level. It will negatively impact on stock market for rise in oil price.

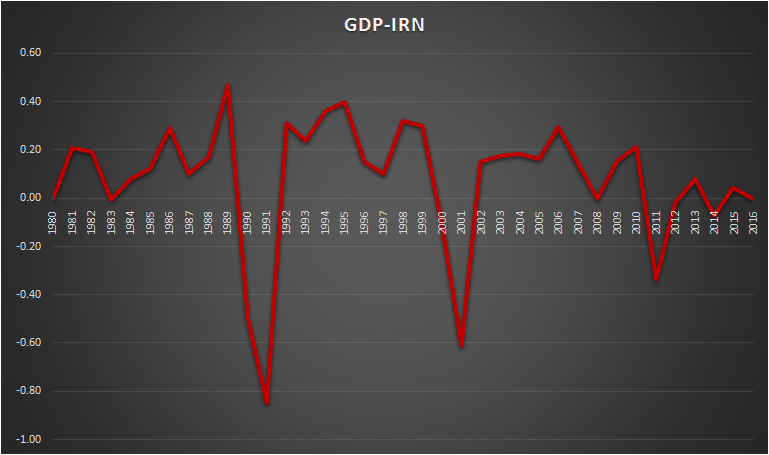

GDP - Gross domestic product is an essential aspect that can interpret and analyse the health and economic condition of a country at a particular period of time. A country's healthy economy try to help organisations to increase the profitability level and try to evaluate the performance of stock market (Mohaddes and Pesaran, 2016, p.265).

From the above graph of GDP of Iran it can be concluded that as oil price is decreased, rate of GDP is also decreased for which stock market is falling. In 2016 the rate of GDP is very low indicating lower price of crude oil and stock market of Iran is falling.

Conclusions and recommendations

Impact of rise in oil price on the stock market is considered as important aspects which should be analysed and interpreted effectively and efficiently in this research study based on the available data and information appropriately. In today’s world oil price rise is an essential factor as it can effect directly on the other regular usable things. As there is gap between the demand and supply of oil, the oil price is continued to rise from which the investors of stock market try to maximise their return.

In this context the researcher should have to understand the relationship between the stock market and oil price properly in order to draw recommendations in this aspect. Based on the information, analysis and data it should be considered that the supply of crude oil in global market will have to be made appropriate according to the demand and that will maintain the proper price of oil globally. The research study is based on only secondary data and information of governmental statistics depending on which analysis have to done effectively and efficiently. Impact of all the above mentioned variables on oil price and stock market should have to be evaluated and interpreted appropriately by the researcher.

You may also like to read:

References

Allegret, J.P., Mignon, V. and Sallenave, A., 2015. Oil price shocks and global imbalances: Lessons from a model with trade and financial interdependencies. Economic Modelling

Bahmani-Oskooee, M. and Saha, S., 2015. On the relation between stock prices and exchange rates: a review article. Journal of Economic Studies

Basher, S.A. and Sadorsky, P., 2016. Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics

Bondia, R., Ghosh, S. and Kanjilal, K., 2016. International crude oil prices and the stock prices of clean energy and technology companies: Evidence from non-linear cointegration tests with unknown structural breaks.

Chakraborty, S., 2015. Impact of Oil Inflation on the Indian Financial Markets and Indian Macroeconomic Landscape. Asian Journal of Technology & Management Research

Dehaghi, M.R. and Mirhashemi, S.M., 2015. Exploring the Effects of Oil Price on Stock Exchange of the Selected Oil Exporting Countries.

Deshmukh, B.G., Jain, P.S., Patwardhan, M.S. and Kulkarni, V., 2016, August. Spin-offs in Indian Stock Market owing to Twitter Sentiments, Commodity Prices and Analyst Recommendations. In Proceedings of the International Conference on Advances in Information Communication Technology & Computing