A. Strategic purpose of the organization

Overview of the organization

Pilkington is a glass manufacturing company that has headquarters in St. Helens. It is a subsidiary company established in 1826. It was acquired by the NSG group in 2006. At that time it was included in the London Stock Exchange. The main operational area is Germany now for the company.

Analysis of the external environment factors: (PESTLE analysis)

Political: Domestic and international politics have influenced the business strategy of Pilkington. Conservative political forces have cropped up and resulted in a stricter domestic market (Swamy and Naik, 2014, p.334). Greece, Spain and some other east European countries have seen intense political tensions and in Germany, the anti-migration voices are gaining ground making the regional business environment politically harsh and stricter.

Economic: The US reserve has lowered the rates but those have not addressed the slowdown trend much. In Germany and other European countries, crackdown of the banking systems has made many countries run without any money (Navarro-García et al. 2014, p.743). China has also slowed down and thus the demand for raw materials has also decreased.

Social: The lifestyle and economic process have also been rapid in the western European region. Germany and the UK are the focal points. People also love to spend there but the Syrian conflict and the migration issue has made a section of Europeans skeptic and more conservative. Same is in the US and the Middle East.

Technological: The road line being made by China that will connect the Western Europe with China and the open border policy in the whole Europe are great technological prospects for that region (Yamak et al. 2014, p.98). Pilkington uses a strong network of customers with advanced technological aspects like Wi-Fi and the Internet across Europe to provide great supply chains.

Legal: The legal battle between the EU and the less powerful European countries continues. Goods trafficking regulations, safety regulations and regulations relating to export and import both into the EU and out of the EU have been questioned by many countries (Mihet, 2013, p.143). New regulations are being framed after the UK’s exit and those are creating new challenges for Pilkington.

Environmental: The Paris Summit on global climate and less carbon emission has made the leading countries in Europe and the whole world become more concerned about their carbon emissions (Liu and Tyagi, 2016, p.130). A global solar alliance has been framed and France is a part of that. Technologies that use less carbon are asked to follow and Pilkington has to abide by that. Environmentally products are also given priority in recent times.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

Analysis of the competitive industry: Porter’s five forces

Threat from new firms: As Pilkington deals in glass manufacturing, new companies often enter into the market with low cost products and challenge it both in quality and reach. This depends on entry market, government policies, legal framework of the country or business organizations, capital, reach, quality, brand value, product differentiation and so on (Burke et al. 2016, p.143).

Threat from substitutes: Asahi Group limited, Compagnie De saint-Gobain, Guardian Industries Corp. are some of the great competitors of Pilkington and there is a possibility that more and more customers may switch over to substitute products made by these companies. The number of substitute products is three at this moment and the product differentiation is also marginal.

Customers’ purchasing power: The ratio of buyers’ concentration and Pilkington’s concentration is modest. The company also depends a lot on its supply chains. The company has also higher fixed costs and thus there is less flexibility for the customers. It also takes differential advantage because of its market penetration and variety in products.

Suppliers’ bargaining potentiality: Labor, raw materials, and services are the main components that are supplied. The raw material is glass and those are supplied by some old companies and the suppliers are also very trusted for Pilkington but the availability of better offer from other companies may influence it to raise the price, substitute raw materials can also change the equation (Loucopoulos, 2016, p.279). Solidarity on the part of employees and a robust distribution channel also affect it.

Rivalry with other companies: Asahi Group limited, Compagnie De saint-Gobain, Guardian Industries Corp. are some of the rival companies of Pilkington and the rivalry also determines the market competition and product quality for Pilkington.

Analysis of the strategic capability of the organization: SWOT analysis

Strengths: Pilkington has a diverse product range that includes solar control glasses, thermal insulation glasses, self-cleaning glasses, and glasses that give protection from fire. These special features add to the strength and quality of the glasses produced by the company (Kashan and Mohannak, 2014, p.168). It is also a subsidiary of the NSG Group that has a huge market base and shops that it can use to market its products.

Weaknesses: It has not developed any manufacturing capability in raw materials and thus it always depends on its suppliers for its products. It also depends on its subsidiary for many funding and operational issues that delay many of its projects.

Opportunities: It has a great opportunity to expand its market to the countries in Asia and the US so that it can recover from the global slowdown as soon as possible. It may also get new customers and suppliers in those countries as those are full in human resource and the onus of global growth and global demand have shifted to Asia and South America (Vogel and Güttel, 2013, p.436).

Threats: The threats are: it may face tough competition from the local or domestic manufacturers in terms of cost and low demand may last long and in that case the stocks may become useless and of low quality.

We believe in serving our customers with the most reliable assignment help

B. The available strategic choices for the organization

Internationalization of the business means that the business organization has many branches across the globe at different countries which act as independent companies. For Pilkington, there are several strategic choices and those are the following:

Exports and imports: This strategy includes exporting raw materials, products such as different glass materials for Pilkington, and services from one country to another (Morris et al. 2015, p.42). The import pattern is the reverse. There are two types: direct and indirect. The first one means that Pilkington itself is involved in the processes and the latter one means that Pilkington is doing the business through some other companies.

Entry through licenses: Pilkington may also get international licenses for manufacturing, selling and supplying a particular product or products. Under international regulations, it may get copyright rights and selling rights (Thompson et al. 2013, p.131). It may produce products for the licensor, sell them in the markets and countries that it wants and then give a percentage of the revenue earned.

Joint ventures: Two companies come together and manufacture a product either by using one’s technology and the other’s raw material or by both using any third company’s raw materials. The partnership may be equal or unequal in terms of its agreement and market power (Turnbull and Valla, 2013, p.145). Most of the international companies make such agreements with domestic or regional companies to get a better market control over the target market.

Direct investment: When a company comes to a foreign market and invests on its own in manufacturing a product or products, it is called a direct investment made by that company. This is often done in a very demand driven market and where the risk potential is the least and the political and economic factors are positive for a long period of time (Nguyen et al. 2014, p.792). Often an agreement between the government and the company follows such an investment.

C. Evaluation of the strategic choices

Application of the SAFe evaluation criteria

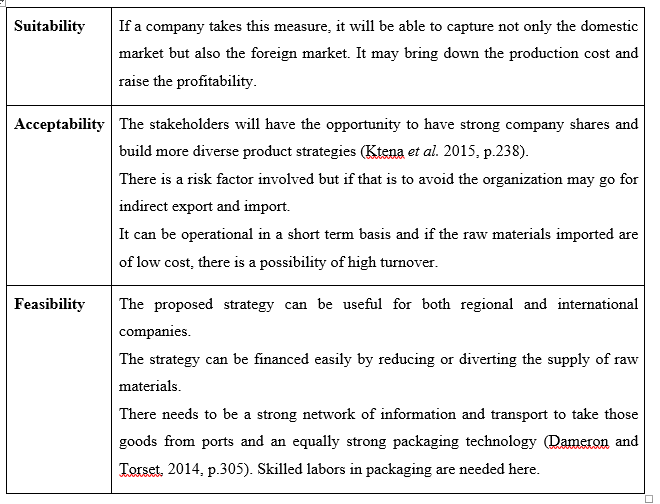

Evaluation of Exports and imports

Barriers to implementation:

This strategy of exports and imports has a few barriers:

(1) Trade relations between the countries may not be very well.

(2) The domestic laws may not support import of some raw materials and also export of some other materials.

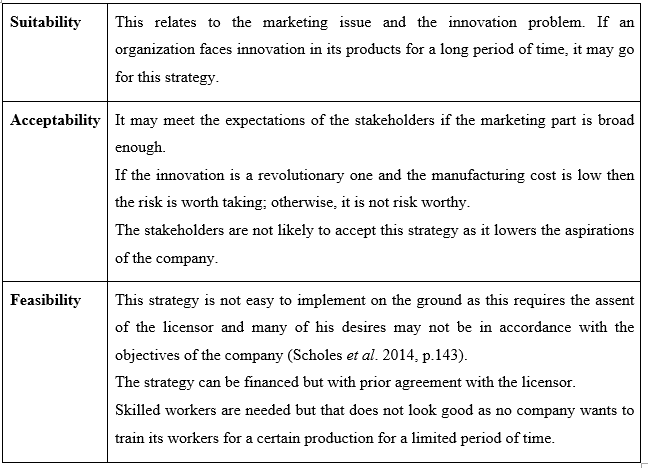

Evaluation of entry through licenses:

Barriers to implementation:

The barriers are:

(1) It requires assent from the licensor and from the international rules and regulations for marketing and production.

(2) It also stays for a certain period of time and that does not suit the long term goal.

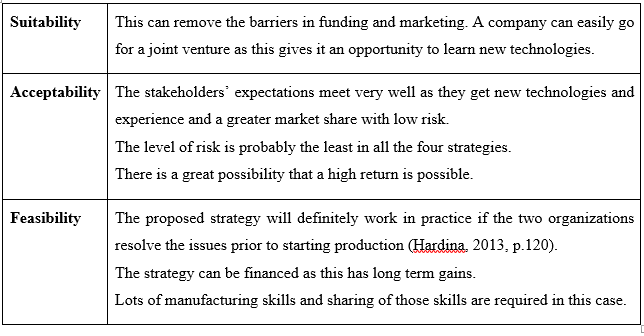

Evaluation of joint ventures:

Barriers to implementation:

(1) It requires a good and through negotiation.

(2) Partnering company is required to be well equipped and creditable.

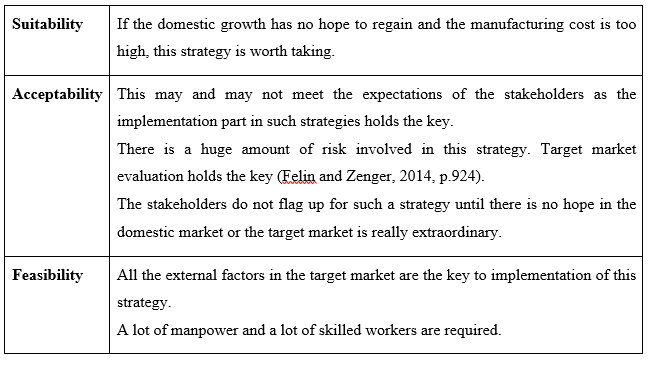

Evaluation of Direct investment:

Barriers to implementation:

(1) Land laws and marketing laws in the target market are often difficult to meet.

(2) Political forces and technological factors are also difficult things to meet.

D. Recommendation of a preferred strategic choice and conclusion

Recommendation of a strategic choice

For Pilkington, the Joint venture strategy will be the best. It requires another company in a target market. That has to be a domestic company. As Pilkington is a glass manufacturing company, it needs a company that has a good reach in a similar domestic market. Pilkington will also be able to sell its products that are environment friendly.

Justification of that choice in terms of stakeholders’ expectations

The reasons behind selecting this strategy are:

(1) The manufacturing cost would come down significantly. As the partnering company will bear half of the cost of manufacturing, the market price of the products will be less and that will attract customers.

(2) Pilkington would be able to access a fully new market in a short span of time. That market will also include customer relationship, suppliers, transport infrastructure and so on. That is a huge benefit for the organization.

(3) It will gain a good knowledge about how the marker behaves in the short and long run. This will help the company decide the future course of action.

(4) Pilkington will get a better marketing share and a great production share for a relatively smaller investment.

Conclusion

It can be said in the conclusion that the organization needs to well evaluate its current market condition and focus on innovation more and more so that many marketing problems are solved. Any marketing strategy is a good one if it is implemented properly the best one is joint venture as this has the best opportunity to encourage innovation and has the best scope for long term sustainable market penetration. Pilkington will have a great opportunity if goes for a Joint venture with a company from China, India or South Africa as these are large developing economies.

References

- Burke, A., van Stel, A. and Thurik, R., 2016. Testing the Validity of Blue Ocean Strategy versus Competitive Strategy: An Analysis of the Retail Industry. International Review of Entrepreneurship

- Dameron, S. and Torset, C., 2014. The discursive construction of strategists' subjectivities: Towards a paradox lens on strategy. Journal of Management Studies

- Felin, T. and Zenger, T.R., 2014. Closed or open innovation? Problem solving and the governance choice. Research Policy

- Hardina, D., 2013. Analytical skills for community organization practice. Columbia University Press.

- Kashan, A.J. and Mohannak, K., 2014. A conceptual analysis of strategic capability development within product innovation projects. Prometheus

- Ktena, S.I., Abbott, W. and Faisal, A.A., 2015, April. A virtual reality platform for safe evaluation and training of natural gaze-based wheelchair driving. In Neural Engineering (NER), 2015 7th International IEEE/EMBS Conference on

- Liu, Y. and Tyagi, R.K., 2016. Outsourcing to convert fixed costs into variable costs: A competitive analysis. International Journal of Research in Marketing.

- Loucopoulos, P., 2016, September. Capability Modeling as a Strategic Analysis Tool: Keynote Extended Abstract. In Requirements Engineering Conference Workshops (REW), IEEE International